Hello, I was very happy with your service as a Brownstone Unlimited subscriber and really enjoyed your biotech coverage. I am still a holder of many of those stocks, despite the move away from biotech by Brownstone, following your departure. What is your current view on Cabaletta Bio? The stock has done very well since it hit bottom in September 2022 and I am up a lot on my position. Do you think it will continue to do well? Thanks. — Caradoc D.

Hello Caradoc,

I’m happy to hear that you found my biotech coverage useful, and thanks for writing in with your question about Cabaletta Bio. I’ve been very anxious to get back into biotech, given the positive developments of the last six months or so.

Cabaletta is an interesting company for us to revisit, as it is a great example of what has happened with so many of the promising biotech stocks that I previously covered.

Cabaletta Bio (CABA) is most well-known for its therapeutic approach to treating autoimmune diseases by using CAR T technology.

CAR T stands for Chimeric Antigen Receptor T cells. This is a popular and promising approach to curing certain kinds of cancer.

Cabaletta takes T cells, which are a form of white blood cells that are critical to the immune system, and engineers those cells to bind to specific kinds of antigens (proteins) that exist on other cells.

These T cells are removed from a patient, modified, and then returned to the patient to do their work.

In the case of Cabaletta, instead of targeting cancer, it uses CAR T technology to target autoimmune diseases by bioengineering its CAR T therapy to bind to certain antigens that reside on disease causing B cells.

By binding to and depleting the disease-causing B cells, healthy B cells are able to perform their function in the human immune system.

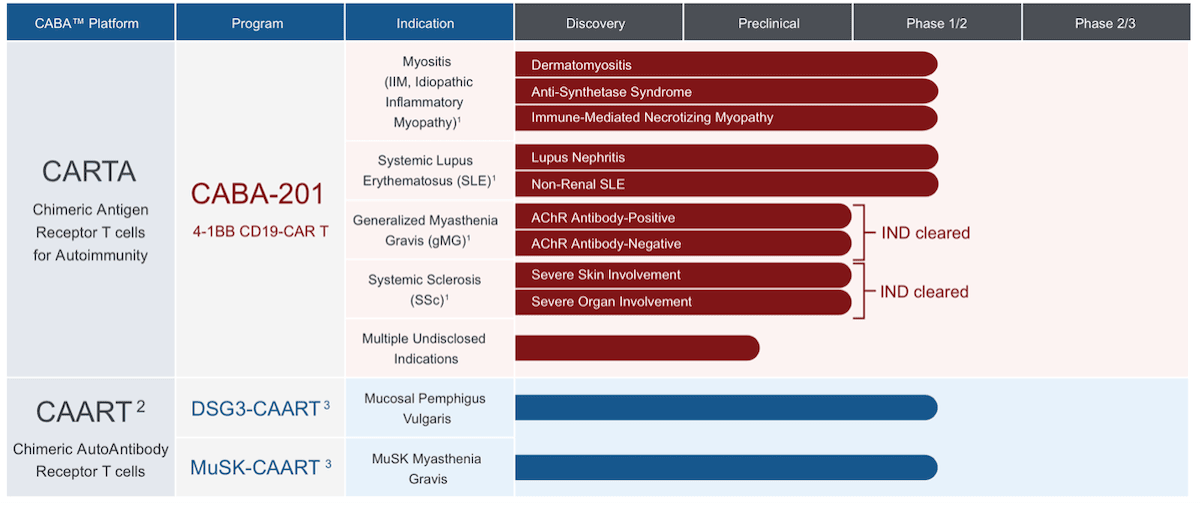

The company has already demonstrated strong progress with this approach and currently has its CABA-201 therapy in two Phase 1/2 trials for myositis and systemic lupus erythematosus (SLE).

This January, CABA also received FDA Fast Track designations for CABA-201, for the treatment of both dermatomyositis and systemic sclerosis. And last month, the FDA granted Orphan Drug designation for CABA-201 for the treatment of myositis.

These are all very encouraging signs and signal the potential for an accelerated timeline to FDA approval and commercialization of these therapies.

It’s important to note that these latest developments come on the back of three years of consistent and positive progress, despite the negative impact of the failed pandemic policies on Cabaletta’s clinical trials.

Cabaletta, like so many other early stage biotech companies, suffered unnecessary delays in their clinical trials during the pandemic.

As we discussed in Outer Limits—End of an Era in Biotech?, it became nearly impossible to conduct and manage clinical trials during the pandemic… as patient recruitment and patient management in clinic trials was extremely difficult.

Fortunately, we finally started to see that change last year, and clinical trials have recovered to what looks like pre-pandemic times.

5-Year Chart of Cabaletta Bio (CABA)

The above chart of Cabaletta is a representative chart of what so many early stage biotech companies experienced from 2020 through today.

I first recommended CABA at an entry price of $10.92. The share price rose to above $15 that year, and then the frustration of the delays of the clinical trials began pulling CABA’s share price down below $1 by late 2022.

And yet there was nothing wrong with Cabaletta at all. Quite the opposite, in fact.

Today, Cabaletta is now trading around $23 — a 109% gain for those that invested back in June of 2020. And of course, those that acquired the stock back in 2022, perhaps to double their position size, have seen extraordinary returns.

As we look forward, there is good cause for more optimism. Cabaletta has enough cash on its balance sheet to fund its clinical trials, research, and development through the fourth quarter of this year.

Our next major catalyst will be the initial clinical data coming from the Phase 1/2 trials in lupus and myositis, which are expected in the first half of this year. At a minimum, I believe it is worth waiting to see what the results of those trials are.

Cabaletta is currently trading at an $800 million valuation and its therapies have the potential to address a very large, multibillion-dollar market opportunity treating autoimmune diseases.

Assuming the results from Cabaletta’s clinical trials are positive, not only will the stock rise, it will quickly become an attractive acquisition target if it is not one already.