Great investment opportunities come from hard work, lots of time, and often boots on the ground research, which is exactly what I’ve been up to…

I’m tracking down a couple exciting, early stage private companies that have caught my excitement.

It usually takes months of research — and often times multiple site visits — to bring these kinds of opportunities to my subscribers, which is why I’ve been on the road…

Where Am I? Take a Guess!

I can’t say much at the moment, as I’m still in research mode and meetings…

But I can say that both companies are operating on the outer limits of their respective fields in two industries that I am extremely bullish about. I hope to be able to share more with you soon.

As for today’s AMA, we have a great question about the biotech sector, so let’s dive in.

Jeff

Hi Jeff, I am very happy to see you back with your investment letter. I was wondering if you still like biotech stocks. I am invested in 35 biotechs, Editas (NASDAQ: EDIT) being my biggest and favorite. Glad your back. — Noel D.

Hi Noel, thank you. I’ve received quite a few questions along the lines of your question, so this is clearly an area of interest. That makes me happy because biotech is one of the industries that I remain most excited about over the next few years.

Your question gives us a good opportunity to take a high level view of the biotech market. We’ll look at a chart of the SPDR S&P Biotech ETF (XBI) as a starting point.

I like XBI for this purpose as it’s an equally weighted ETF — meaning all the holdings in the ETF have equal weighting. The other major biotech ETF — IBB — is heavily weighted towards the larger players.

For example, for IBB, Amgen makes up 9.01%, Vertex makes up 8.72%, Gilead Sciences makes up 8.57%, and Regeneron makes up 8.53%. So XBI provides us with a broader, more balanced perspective of the state of the biotech market.

One thing that immediately jumps out at us is that the biotech market is currently trading at levels seen back in 2019…

This is quite hard to believe, considering the incredible breakthroughs we’ve seen in biotechnology and in particular the application of artificial intelligence and machine learning to life sciences and drug discovery over the last few years.

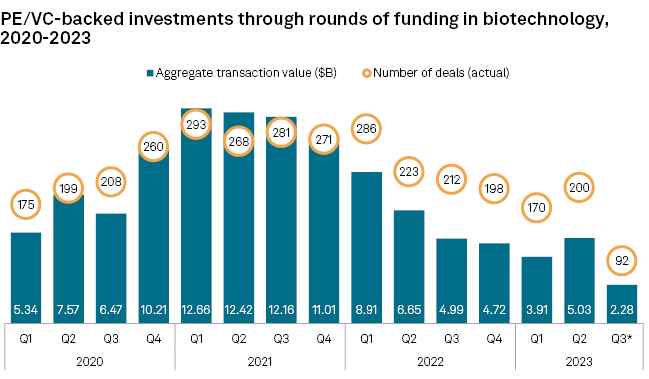

It’s also worth having a look at private equity and venture capital (PE/VC) levels of investment into the biotechnology sector during this time.

As we can see above, investment into the private biotech sector was at record highs in 2021…

But the levels of investment nearly halved in 2022 — from $48.25 billion down to $25.27 billion. And through September 1, 2023, investment levels are looking like they will be even lower for the full year.

What happened? The engineered-virus, political pandemic happened. And the negative impact on the biotech sector was material.

Specifically, health care facilities made pandemic policy decisions. And the effects of those decisions made it extremely difficult for biotech companies to run clinical trials.

They had a hard time managing clinical trial patients, for example, as so many didn’t want to visit any medical care facilities during this time.

And without functioning clinical trials, the industry didn’t have the normal reporting of clinical trial results. That meant there was limited information for the markets to react to.

The biotech conference circuit also dried up. Yes, there were the remote conferences, but the interactions between investment banks and public biotech companies weren’t the same.

Meanwhile, the dearth of trial data made it hard for institutional capital to get excited about investing more capital in the biotech sector. If anything, they were pulling capital out of the publicly traded stocks.

The only area of biopharma that was attracting attention were companies like Pfizer and Moderna, who were making tens of billions off the COVID-19 “vaccines” (i.e. experimental drugs).

Ironically, Pfizer is now trading at levels not seen since 2019 and the stock price has collapsed, as more than 80% of the U.S. population has chosen not to take the COVID-19 booster shots. Smart.

It’s clear from the biotech ETF (XBI) that institutional capital simply hasn’t come back into the biotech sector yet. But this is also true of almost the entire market…

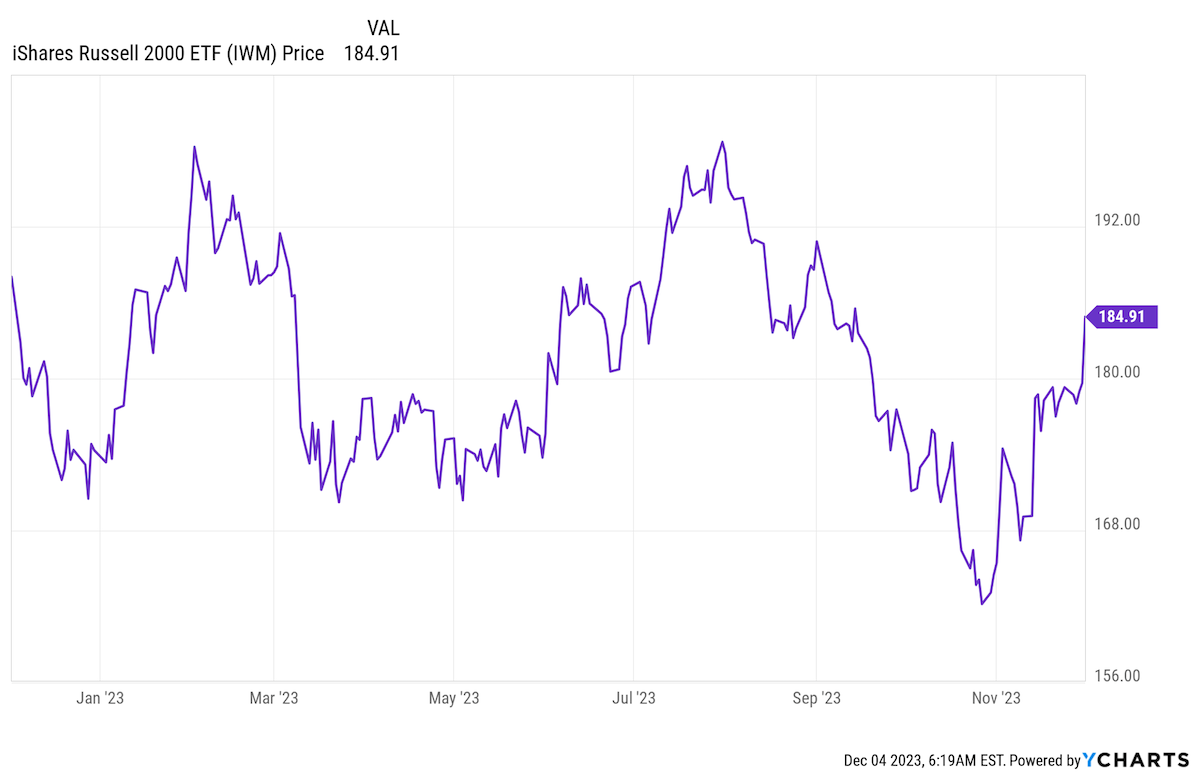

Even when we look at the Russell 2000 index, a broad representation of the small capitalization sector, we can see a lot of volatility and an index that has barely moved in 2023.

This is all to show us that small caps in general have received very little interest this year, and most biotechs are small cap stocks.

It’s also important to note that almost the entirety of the run-up in the NASDAQ this year has been driven by seven large cap stocks that have exposure to artificial intelligence.

With interest rates so high and a weak economy, this is not a good environment for publicly traded stocks. We do not yet have healthy economic conditions and solid fiscal and monetary policy that’s beneficial for publicly traded stocks.

With all that said, I can’t think of a sector that is more undervalued — and that has so many incredible developments — as the biotech sector. It is “cheap” and out of favor right now, which means that there is incredible upside ahead.

So to answer a concern: Did we witness the end of the biotech golden era? Absolutely not. It is just getting started…

I absolutely love what I’m seeing in the biotech industry right now. The heavy PE/VC investment back in 2019-2021 is now producing results, the employment of AI is accelerating drug discovery, and there has been incredible progress with things like genetic editing technology.

From an investment perspective, we’ll be looking for the return of institutional capital back to the biotech sector. That’s what it will take to ignite publicly traded biotech stocks.

The foundation is there, clinical trials are returning to pre-pandemic norms, and the biotech conferences and M&A activity have been picking up.

We’ve had to be patient, but the next biotech bull market will be worth the wait. This is something that I track closely and will be anxiously waiting to jump back in when the time is right.

In the meantime, I’ve been scouting the private markets for biotech investment opportunities, which have been very active this year despite the public markets.

I’m ridiculously excited for what’s to come…

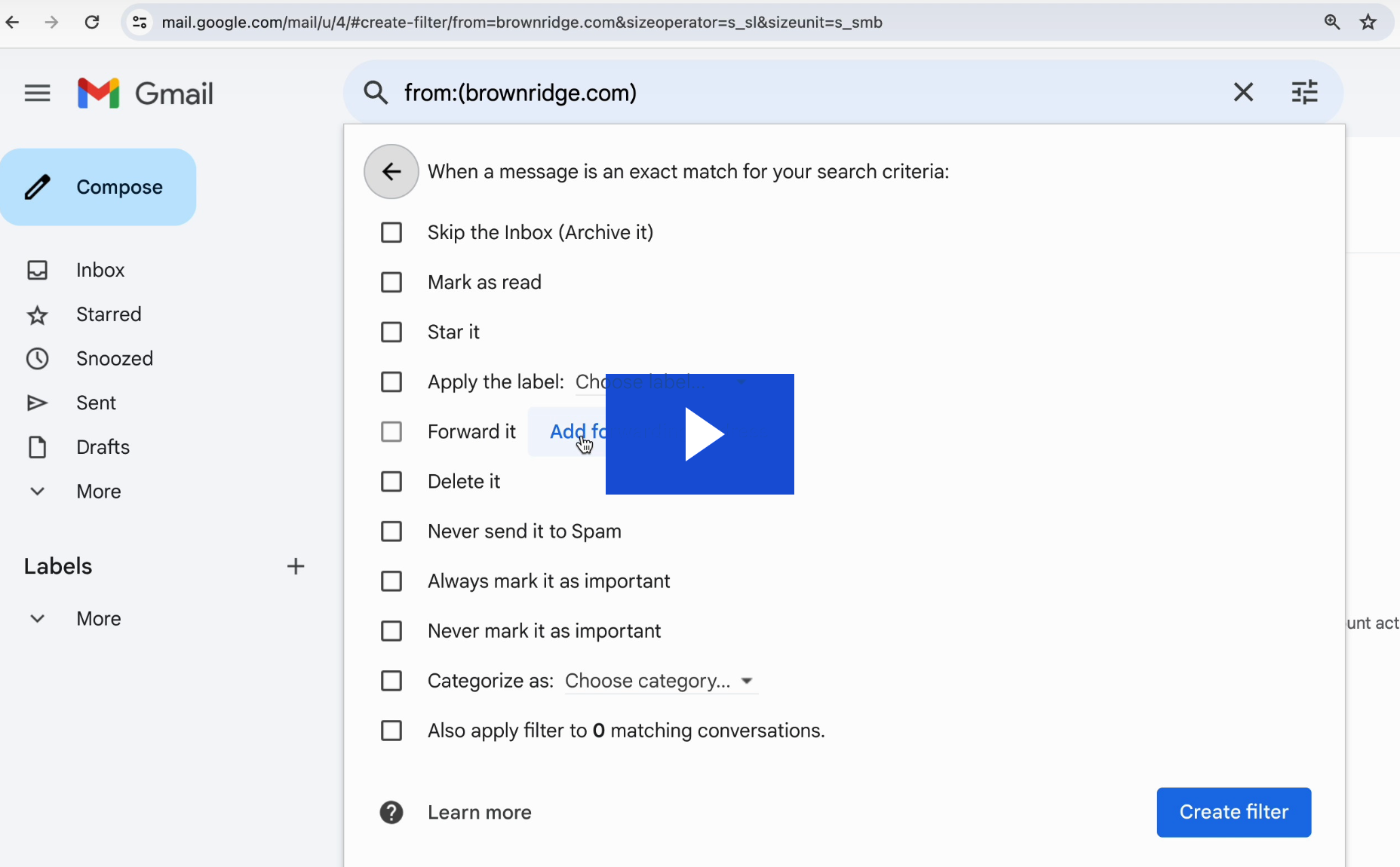

Lindsey’s Note: We’ve received quite a few notes from subscribers who aren’t receiving the Outer Limits issues, despite signing up multiple times. Here’s what to do if you think you could be one of them.

Because the www.brownridge.com domain is still new, we haven’t yet built up enough sender reputation with the big email providers. So some of the e-letter issues may not be making it to your inbox.

If you’re worried your email provider is filtering out Jeff’s e-letter, please make sure to take the following whitelisting steps:

Along the way, please mark any emails from us in your spam or junk folder as safe.

Taking these steps will signal to the email service providers that we are a trusted source of information, and ensure you never miss an email.

If you’re unsure how to whitelist, please click here for preliminary instructions for the major providers.

Thank you for helping to ensure the future success of Brownridge Research!