Hi Jeff, I’m glad that Republic sent me an email that you have a new newsletter. Hurray! I was a long-time reader and subscriber of your newsletters. I especially loved (and still love) Day One Investor. I’m just wondering if you have plans to do more private placement, early Reg A investment opportunities? I would LOVE that as I am so grateful for your previous work with Day One. Thank you sir and happy holidays! — Mike S.

Hi Mike, thanks for the feedback. You and I are in full agreement.

The back story that you haven’t heard yet is that I had been working on finding ways to provide my subscribers access to pre-IPO shares in private companies since 2015. There were some ways to do it, but most required investors to be accredited, which I didn’t like.

And back then, crowdfunding regulations were not yet attractive to private companies because Reg CF offerings were limited to raising just $1 million in every 12 month period. That just wasn’t enough to attract promising high-growth companies to raise capital.

I had to wait patiently for regulations to evolve, specifically for the cap to be raised for Reg CF deals to $5 million. That happened in 2020, and then was implemented in 2021, opening the door for me to launch Day One Investor at my former employer.

Delivering on an investment research service like that is extremely hard work. Much more so than any other research product I built.

It requires deep expertise and networks in the private, early stage markets, the ability to collaborate with multiple parties to bring a deal to life, the ability to research private companies and their potential with imperfect information, and a whole lot of hustle.

I remain just as passionate about providing access to private markets to my subscribers, perhaps even more so, now.

As I now own Brownridge Research, as opposed to just being an employee of a company, there are now things that I’ll be able to do that weren’t possible before. It will make for an even better research product and better investment opportunities.

Having an asset allocation strategy that includes private investments is one of the most critical secrets to creating generational wealth. It is something well understood by high net worth investors, but we rarely hear about it.

By way of example, globally high net worth investors allocate 34% of their total portfolios on average to private investment opportunities.

And when we look at just the U.S.-based high net worth investors, the percentage rises to 47%.

Incredible isn’t it? It’s not 10% or 15%. It’s 47%. That’s a big hint.

Another important dynamic for us to understand is that the public markets — and even the late stage private markets — are heavily manipulated.

Venture capital and private equity firms work hard to keep the most exciting private companies private for extremely long periods of time, usually more than a decade.

Their goal is to grow the private companies into multi-billion dollar companies and wait for an ebullient market to take the companies public at the highest valuation possible.

The best companies are now going public when they have already grown into massive companies. And the venture capital and private equity firms behind them dump shares onto unsuspecting retail investors the first chance they get. After all, they know that they’re taking the company public at an inflated valuation.

Said another way, by keeping the companies private for such extended periods of time, they hoard the majority of the profits for themselves, and then leave crumbs for the retail market.

This frustrates me to no end. And the more brand name a company is, the more “the market” can take advantage of retail investors who have no understanding of valuation.

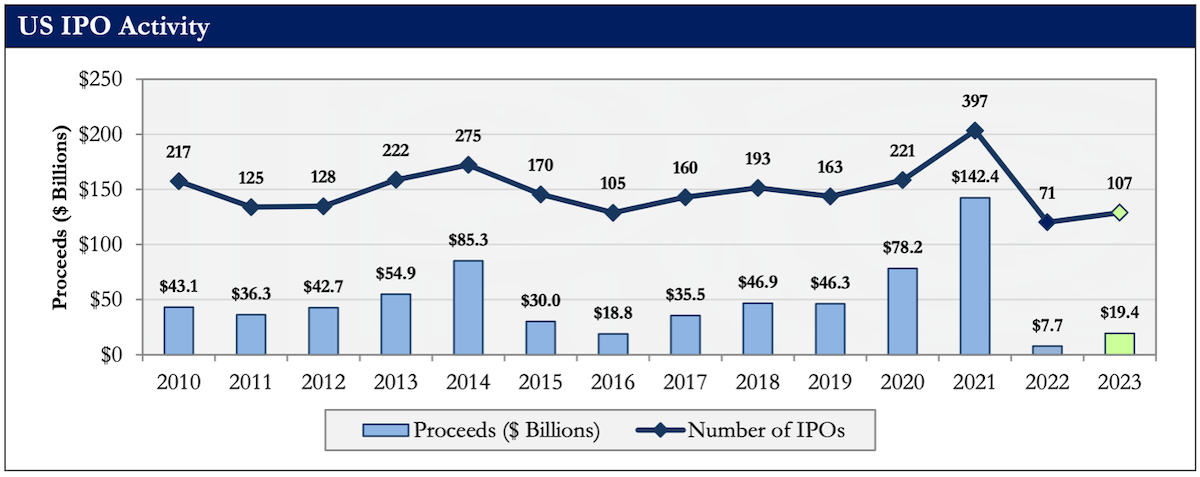

Oddly enough, in a year like 2023, with such a hot tech market, we would have thought that IPOs would have returned in mass. But it didn’t happen at all.

As we can see in the graph above, 2023 was one of the worst years for IPOs.

Yes, it was in improvement over 2022, which was a complete disaster, but still, this year was one of the worst on record. Only $19.4 billion was raised across 107 IPOs, most of which were completely uninteresting.

This is because almost all the gains in the S&P 500 were driven by the Magnificent Seven stocks, a topic we discussed in last Friday’s Ask Me Anything (AMA), which can be read here.

As a result, high growth private companies still didn’t perceive the current markets to be strong. They couldn’t get elevated valuations if they went public, so they chose to stay private longer.

My point is that this dynamic isn’t going away. This technological acceleration is creating generational wealth everywhere.

Do we really think that venture capital and private equity firms will give up their gains and allow their portfolio companies to go public earlier for the benefit of retail investors? Hell no.

And that means that we’re going to have to create our own opportunities for private investments.

Mike — sorry to wait so long to tell you — yes, I’m going to launching a private investment research product, and it will be even better than Day One was when I was in charge of that product. It’s coming… soon. And I already have two exciting deals in my pipeline that I can’t wait to talk about.

And one more thing — some of you may have noticed something on the top of my website. I have a place for “Founders & CEOs.”

I wasn’t able to do this before, but now I am. My company, my rules.

I’ve created a way for founders to connect, tell me about their company, and upload a pitch deck for my review.

I’m very picky. But if I like what I see, I’ll always reach out and follow up for a deeper dive.