We’ve just welcomed a wave of familiar faces to the Brownridge family. Hello, everyone!

If you’re an old reader of mine, I wanted to take a moment to say I’m thrilled we have found each other again. I encourage you to check out what the new Brownridge Research is all about right here.

I’d also like to point out: You’ve made it to the Outer Limits, my new daily e-letter, where we track the outer limits of tech and biotech, as well as the extremes of monetary, fiscal, and geopolitical policies.

After all, these things affect the markets and investment opportunities, so understanding them is critically important.

The back issues from the last few weeks can be found right here. We’ve been having a lot of fun and exploring some incredible topics.

It won’t take long to catch up. I promise it will be worth your time.

I’m excited to have you aboard. We have a lot of catching up to do.

In this week’s Ask Me Anything (AMA), we’re going to take a fresh look at an incredible small cap semiconductor company — Akoustis (AKTS)…

But more important is my wish for all of you to have a wonderful Christmas and New Year’s holiday.

After such an insane and crazy year, I think we all probably need a break. And I’m absolutely sure we’re going to need some energy for what’s coming in 2024. More on that for another issue…

I do plan on writing next week, Tuesday through Friday, so I’ll have some interesting holiday reading in Outer Limits.

Merry Christmas.

Jeff

At one time you had established a portfolio of 100% gains in Aug 0f 2022. Some of those stocks were: RGTI, RBOT, AKTS, and SDGR. I think there were 15 stocks in all. I was wondering your take on these four in particular and especially AKTS? Thanks for allowing us to find you again. — Carl H. D., Jr.

Hi Jeff, it is great to hear you are back. I would love if you could give us an insight on one company that you strongly recommended. Akoustis Technology, AKTS. Are you still bullish on this company (if so why). And would you recommend doubling down on it, since its price its at its low, or is just holding the best choice (if so why). Hope you could answer, and hope you the best. — Cristian

Hello Carl and Christian, thanks for writing in with the questions. We’ve had quite a few about Akoustis (AKTS), so it’s a good opportunity to take a fresh look at this exciting small cap semiconductor company.

Before I do so, Carl, I did provide an updated view on Rigetti (RGTI), a quantum computing powerhouse, in my December 12, 2023 AMA. If you didn’t yet have a chance to review that, you can find it here.

Akoustis was on fire through February 2021. Then it suffered as capital flew to safety when the Federal Reserve started aggressively raising interest rates. This wasn’t just something affecting Akoustis, but the majority of the small capitalization stocks.

This is quite a normal dynamic when we see sharp increases in the Fed Funds rate and U.S. Treasuries become more attractive investments. As we know now, large institutional capital did come back to the tech market, but it was very lopsided.

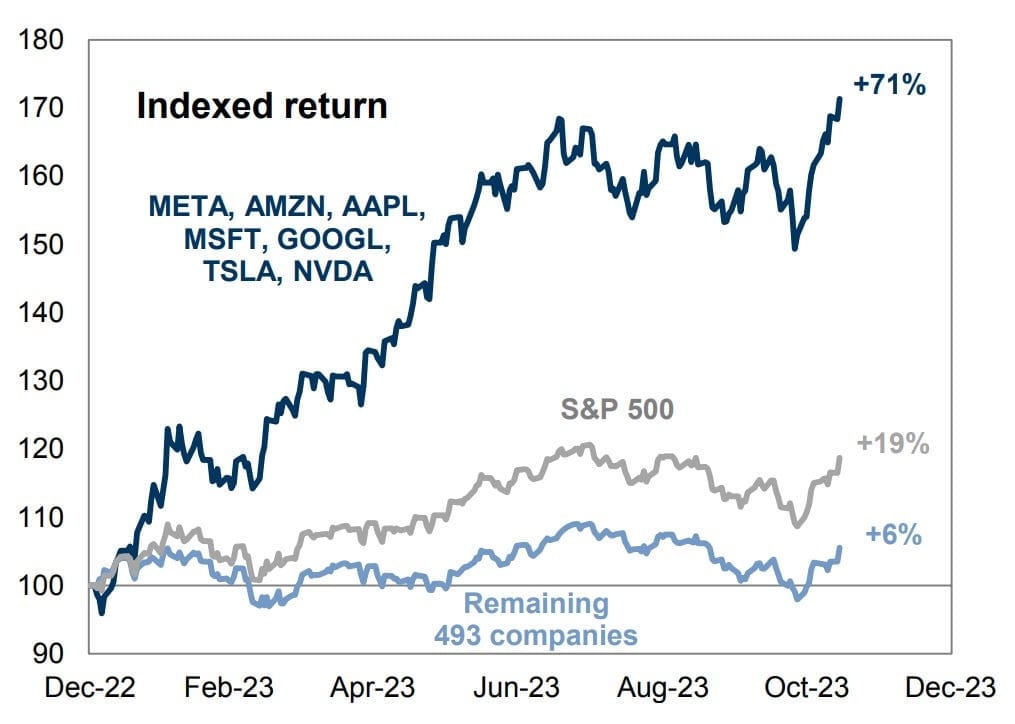

What are now being called the Magnificent Seven — namely Meta (META), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Tesla (TSLA), and NVIDIA (NVDA) — were responsible for almost the entire run-up in the S&P 500 this year.

The chart below is a nice visual of this effect. The Magnificent Seven were up 71%, and the remaining 493 companies on the S&P500 are up a meager 6%.

Perhaps, not surprisingly, all seven of these stocks have strong links to artificial intelligence, which was by far the hottest trend of 2023.

The draw of institutional capital into artificial intelligence left many fantastic, high-growth companies with lackluster stock performance this year.

That has definitely been frustrating. But it is only temporary.

Small capitalization stocks always swing back, especially during markets when interest rates start to decline.

Aside from the bear market in small caps, Akoustis was also impacted by some major cyclical swings in the semiconductor industry. The impact of the pandemic made normal swings that much more exacerbated.

If we remember, as the failed pandemic policies kicked into high gear, we saw shortages everywhere.

The semiconductor industry experienced shortages for certain kinds of chips that dramatically impacted the automotive and consumer electronics markets. The shortages tended to come from the capacity constraints of more mature semiconductor technology.

The industry responded by increasing manufacturing capacity. The absurd trillions of dollars of government stimulus ignited consumer demand, which eventually resulted in too much manufacturing capacity.

Semiconductor inventories built up across distribution channels, resulting in a glut, which always leads to lower margins and a decline in revenues.

After generating $598 billion in revenue worldwide in 2022, the semiconductor industry declined significantly this year (2023) to about $526.5 billion. That’s a large drop year over year.

These industry dynamics help us put Akoustis’ business into context, as three of its most important end markets are Wi-Fi (routers, set-tops), automotive, and 5G-enabled mobile devices were directly impacted.

As a reminder, Akoustis is known for manufacturing the highest performance radio frequency (RF) filters in the world. It has developed proprietary materials that enable unique and advantageous performance characteristics that are most obviously demonstrated in the 1-7 GHz frequency range.

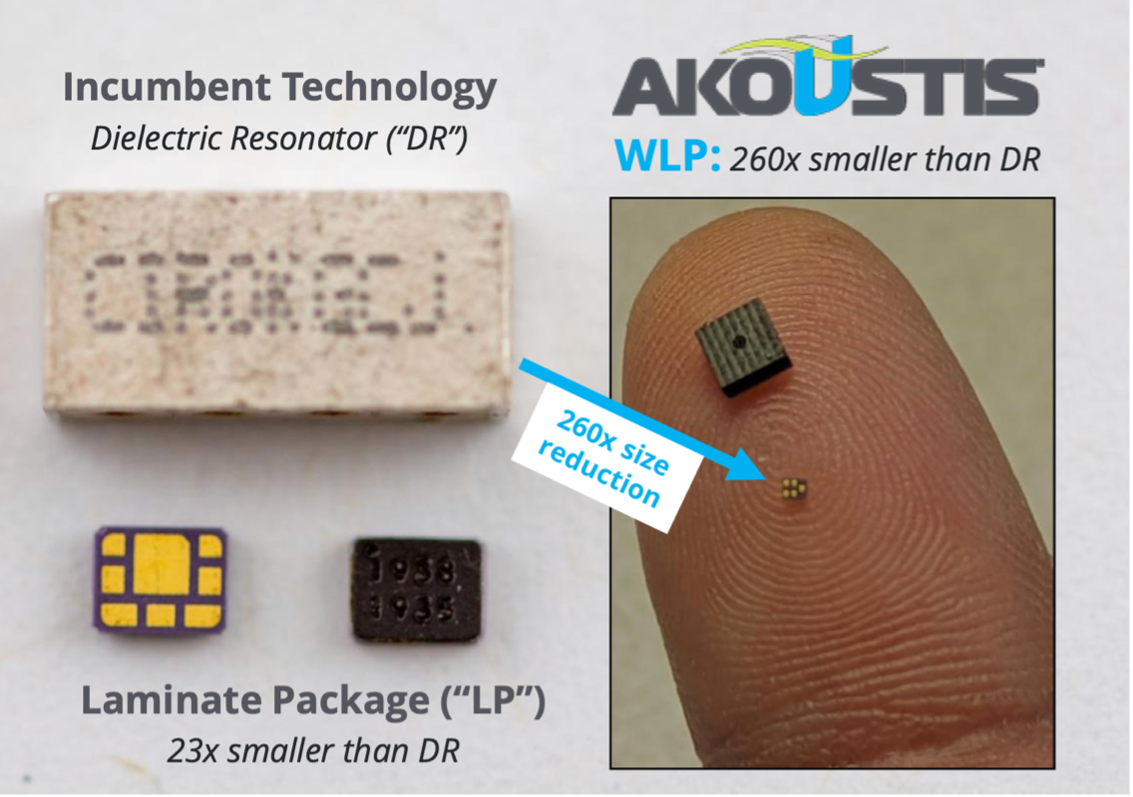

These are tiny devices as shown below. One of Akoustis’ RF filters — shown on the fingertip in the image — demonstrates a 260-times reduction compared to incumbent technology.

This tiny size is important, especially when we’re considering their use in mobile devices like smartphones.

These filters are critically important at these higher radio frequencies, as they block interference from adjacent frequency bands.

A simple benefit of this technology for something like a mobile phone is a reduction in dropped calls, improved call quality, and increased battery life. This would be true of any mobile device incorporating Akoustis’ technology.

And whether it is consumer electronics devices, new Wi-Fi technology, 5G-enabled devices, or 5G network infrastructure, the reality is that they are all using higher frequency bands necessitating the need for the kinds of products that Akoustis is known for.

Akoustis, like other semiconductor manufacturers, was impacted by the inventory excesses and slowdown in consumer electronics spend that we saw in 2022 and this year (2023). Wi-Fi routers and Wi-Fi access points are a perfect example.

If sales in those devices slows down, so does Akoustis’ business.

As a result, Akoustis implemented cost cutting measures this calendar year that will result a 20% reduction in operating costs by its 2024 3rd fiscal quarter (first calendar quarter 2024). These changes will result in positive product margins and operating cash flow breakeven within a year.

I’m sure this was a painful process, but it was necessary. Revenues were down year over year in its Q1 2024 fiscal year results (third calendar quarter 2023), which is something Wall Street doesn’t like to see.

But aside from these necessary adjustments, there is a lot to be excited about concerning Akoustis:

This last point is important to highlight.

If Akoustis is at fault for anything, it would be that it was too early to the market. It was developing technology for a market need years before there was strong demand.

That can make it difficult for Wall Street to follow — investment banks often lose their patience for a story like Akoustis.

But being early has its advantages.

Akoustis was able to systematically map out an incredible intellectual property portfolio for its RF filter technology. It now has 105 patents issued and 108 additional patents filed.

And smartly, Akoustis’ patents encompass not just the semiconductors, but also the packaging, the system, the manufacturing process, the materials used, and even the substrates upon which the filters are produced.

From my perspective, Akoustis’ patent portfolio for its unique materials, RF filters, and manufacturing process are so strong, its competitors are only left with two choices: a) license Akoustis’ technology or b) acquire Akoustis outright.

As I’ve pointed out in my previous research on Akoustis, I believe that Akoustis will eventually be acquired by a larger semiconductor player like Skyworks, Qorvo, NXP Semiconductors, or Broadcom.

But until then, it has plenty of growth ahead of it.

I expect to see some material improvements in the 5G infrastructure market in the first calendar quarter of next year, which will be good for Akoustis. And I expect this sector growth will continue for the remainder of 2024.

The reason for this is that 5G wireless carriers are now spending more money on extending their 5G networks, specifically the small cell (small base station) market.

Said another way, the majority of the 5G networks have been built out to provide broad coverage, and now the wireless carriers are filling out the networks where there isn’t yet coverage, and also improving overall network performance.

While consumer electronics and 5G mobile opportunities were slower this year, Akoustis’ defense-related business has been going extremely well.

This doesn’t come as a surprise, as defense applications require high-performance in mission critical applications. It’s a perfect fit for Akoustis’ products.

One thing that has been a huge disappointment to me, at no fault of the team at Akoustis, has been the lack of progress from the CHIPS Act.

The CHIPS Act was signed into law in August of 2022, providing for $52.7 billion in future grants to ensure U.S. leadership in semiconductor technology.

There’s only one problem: The current administration hasn’t done anything with it to benefit U.S. semiconductor companies. Unbelievable.

Akoustis would have been near the top of my list, a perfect fit for a program like this — after all, companies like NVIDIA, AMD, Qualcomm, or Intel have plenty of money. Smaller companies would benefit so much more from grants.

As a clear slap in the face to U.S. companies, the administration made the very first grant from the CHIPS Act on December 11, 2023. And get this…

It was $35 million to BAE Systems — a British company. Unreal.

I like BAE Systems, but you’ve got to be kidding me…

At a minimum, Akoustis will receive tax credit refunds from the program of between $3.5-4 million over the next 18 months. But what it would really benefit from would be a large grant to invest in even further expansion of its U.S.-based manufacturing facilities in New York state.

I know this is a lot of information, but there are quite a few moving parts with this story. What I outlined is the short version.

Akoustis is currently trading at a $74 million valuation, about 2.6-times the last twelve months of sales.

It’s too cheap — way too cheap. Almost as if it assumes there is zero value to Akoustis’ intellectual property portfolio.

My one short-term concern is that Akoustis will likely have to raise additional capital within the next four quarters. If the small cap markets don’t improve in that time frame, that could mean a lower share price in the short term.

But when I look beyond that short-term capital need, I remain as bullish as ever on the prospects for Akoustis. Its progress over the last couple of years in a very tough market has been impressive, and its patent moat is incredible.

The market has been coming to Akoustis, and there are much higher valuations ahead.

What do you think of this issue of Outer Limits? As always, we welcome your feedback and questions, and look forward to them. We read each and every email. Please write to us by clicking here.