Thank you all for the engagement this week.

There was clearly a lot of interest in Tesla and self-driving software, so the questions gave us the opportunity to dig quite a bit deeper on several interesting topics.

For whatever reason, Tesla is always a polarizing subject.

I remember when I first recommended Tesla in early 2017. It was the most hated and controversial recommendation I had ever made to my subscribers.

I’ve never received so much vitriol. People wrote to me saying I was “crazy.” They said they’d “pass on that recommendation”… or even “no way in hell would I buy that stock.”

Tesla’s risen about 25X since then to its peak in 2021. Even with the latest pullback in Tesla shares, it’s still up 10X since that time.

Even today, after so many years, many still don’t understand what Tesla is doing.

That’s why it’s so much fun to write about.

I hope you enjoy the questions today… and hopefully learn more about Tesla and autonomous driving technology along the way.

Have a great weekend,

Jeff

Hi Jeff and all, with the building of these drone weapons, the materials used to build them will become critical as to suppliers and submanufacturers. Is there an investible sector or industry to research? Titanium, fuel, electronics, computers, etc. Cheers. — Brian C.

Hi Brian,

This is the right way to think about investment implications.

At a very high level, if we assume that the current geopolitical policies by the U.S. continue, we can also safely assume there will be a lot more war. And $100s of billions more will be spent on defense.

Clearly, there will be a lot of companies that will benefit from the excess spending.

Primary beneficiaries will, of course, be aerospace companies with strong businesses in defense, as opposed to something like commercial aviation. Boeing is an example of a company to avoid, due to heavy exposure to commercial aviation, not to mention all of the process and safety problems the company has been having.

Select, publicly traded, legacy defense sector companies have had some success in this environment. And as I’ve written in Outer Limits, some of the most interesting developments in the defense sector are with high growth private aerospace and defense companies.

These companies are worth tracking because they often get acquired by larger, publicly traded companies… and then immediately become investable. And some also go public, giving retail investors the ability to gain exposure. We’re going to be keeping an eye on the most promising of them.

And yes, there are definitely implications and opportunities for the semiconductor industry.

The one dynamic to keep in mind, however, is that defense volumes are a lot lower than something compared to a consumer electronics device. Conversely, gross margins for semiconductors and electronics subsystems in the defense sector are extremely high.

Technical specifications and requirements due to heat, vibration, and radiation are quite different, which results in higher pricing for functionally similar semiconductors. It’s just that the volumes are low.

My point is that if defense-related semiconductors are developed and sold by a massive company like Texas Instruments (TI), a strong defense business won’t really move the needle. TI is just too big. But for a smaller semiconductor company where defense business makes up a large part of the business, then it is a different story. That’s what we need to analyze.

Money & Markets analysis feels differently about TSLA: Why isn’t Tesla rolling out this FSD tech in America? Because American authorities would never allow it. The National Highway Traffic Safety Administration (NHTSA) recently reported on the hundreds of crashes and dozens of fatalities already linked to Tesla’s autopilot features. The report details how Tesla’s autopilot is technically capable of self-driving in ideal conditions. But it also gives the driver a false sense of security. Drivers often react too slowly, failing to interrupt and avoid an accident. In other words… Tesla’s autopilot is only capable of self-driving when it has a driver at the wheel who’s ready to take over within a moment’s notice. It’s basically at the same level of sophistication as a student driver. This is why Tesla cars sold in America come with such extensive warning labels and documentation. And why our government would never greenlight the rollout of FSD Teslas using the company’s current technology. Why did Tesla choose China? At first, China seems like a slam-dunk location for Tesla to roll out its FSD cars. It’s one of the biggest countries in the world, with a growing middle class and a more “relaxed” regulatory environment than you’d find here in the States. None of that’s really news, though. Tesla has been trying for years to crack the Chinese EV market. It’s had some limited success. Then, over the last year, China’s domestic manufacturers have been absolutely pummeling Tesla’s production capacity. One of the companies taking Musk to the cleaners is BYD. This Chinese EV maker was once a choice investment of Warren Buffett, and it currently holds a commanding 31% market share in its home country. By comparison, Tesla had carved out 10.5% of the Chinese EV market in the first quarter of 2023. But by the fourth quarter, that number had dwindled to just 6.7%. That means that in 2023 alone, Tesla lost 40% of its Chinese market share. So you can see why Musk is desperate for good publicity about TSLA. (Apparently, the writer thinks that FSD is ’25 or later for implementation). — Billy B.

Hi Billy,

The issue of some kind of regulatory approval for self-driving cars is an interesting one. This is obviously new territory and there is a lot of discussion around what it will take to gain approval for a widespread autonomous driving network, or for individual cars.

I’m not as pessimistic as others are, however. After all, several companies in the U.S. have been operating autonomous ride hailing services in several cities in the U.S. They have received regulatory approval to do so, and there is no safety driver in the front seat.

All of those deployments, however, are currently geofenced. Their approach to autonomy has been very different than Tesla, which can operate anywhere, on any road.

But aside from the approvals already given to companies for autonomous services, there are other reasons to be optimistic, as well.

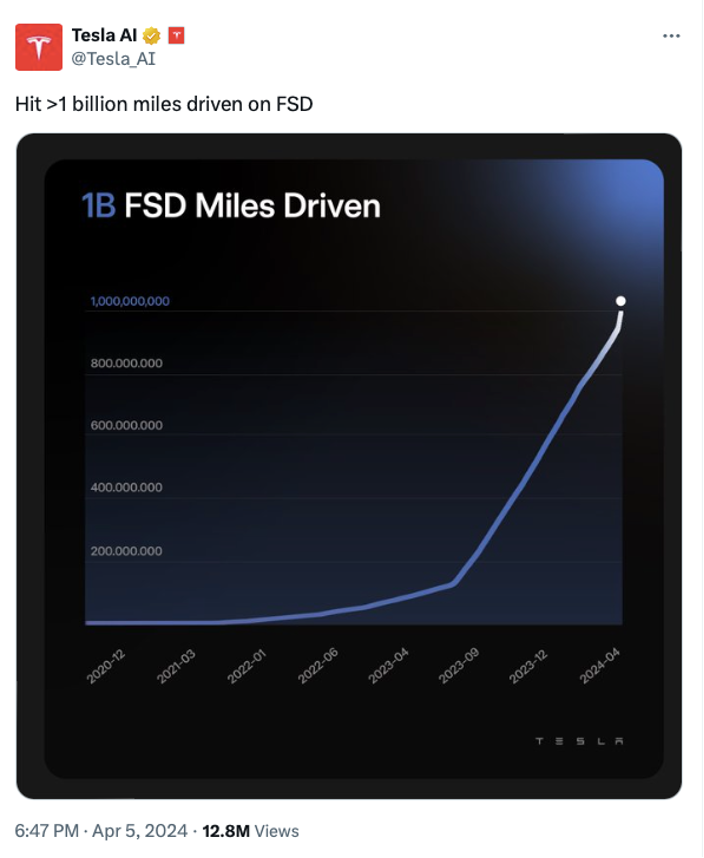

About one month ago, Tesla hit a major milestone, 1 billion miles driven on full self-driving software.

It is important to note that full self-driving (FSD) is different than Autopilot. There have actually been more than 9 billion miles driven on Autopilot already.

Autopilot is designed for use on multi-lane roads with clear lane markings and enables autosteer and adaptive cruise control functionality. We can think of Autopilot as a small subset of FSD capabilities.

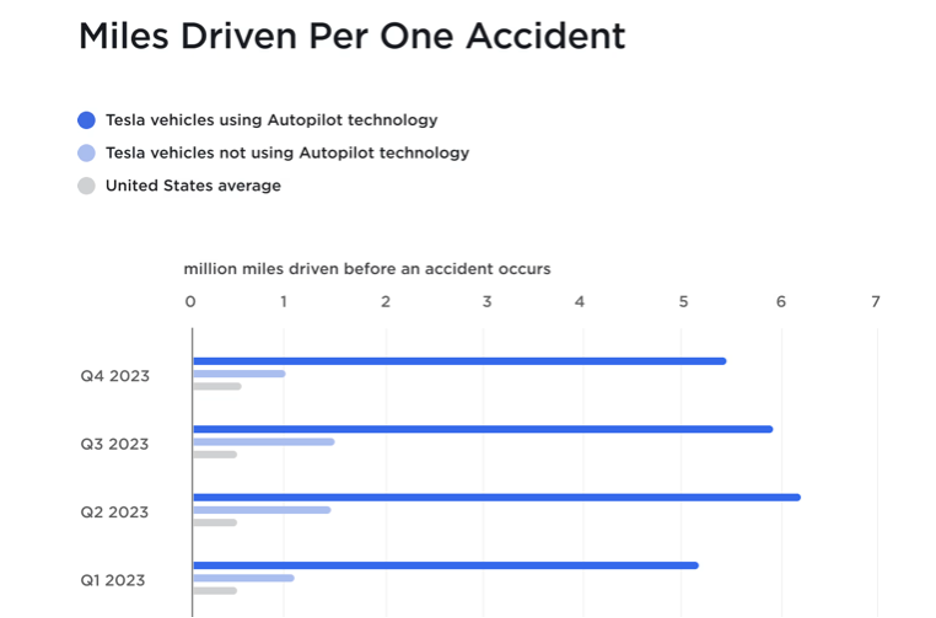

The numbers for Autopilot are already impressive.

In 2023, on average, a Tesla vehicle using Autopilot technology would only experience an accident every 5.7 million miles or so. And yet the average in the U.S. is an accident roughly every 500,000 miles. Teslas on Autopilot result in about 10-times fewer accidents than the U.S. average.

As for full self-driving approvals, the data is already compelling. Elon Musk has previously said that he believes that any company will need to collect about 6 billion miles on fully autonomous mode before gaining worldwide regulatory approval. (Note: This is just Musk’s rough estimation, it’s not based on any existing rules or regulations.)

Approvals in individual markets like the U.S. and China will happen much more quickly with fewer total miles driven I believe. And with Tesla now collecting each additional 1 billion FSD miles every 6 months or so, it should have more than 3 billion fully autonomous miles in less than 1 year. No other company is close to those numbers. And the results will be far better than those demonstrated by human drivers.

As for China, BYD definitely outsells Tesla in terms of number of cars. The key dynamic for us to understand though is that BYD and Tesla target very different markets. BYD’s EVs are much cheaper. It is a totally different performance, quality, and safety profile. BYD’s compact Seagull EV starts at $9,700 in China. Tesla’s Model 3 starts around $37,000.

Despite that, Tesla had about a 12% market share in China for the full year of 2023. I believe that this is an impressive market share considering the large gap in price points between Teslas and the average Chinese EV.

But aside from the China domestic sales, China is still an important market for Tesla as its Shanghai Gigafactory is also an important manufacturing base for the market in Asia. And training its AI on FSD data from mainland China will also improve overall FSD performance in other Asian markets. In other words, Tesla’s presence in China is not just about mainland China sales.

New technologies are always going to get additional scrutiny, and this will be especially true for Tesla due to Elon Musk’s stance on freedom of speech. But Tesla’s progress and safety standards speak volumes. Tesla manufactures some of the safest cars in all categories, irrespective of EVs or otherwise.

And while its autonomous software is not perfect yet, it has already demonstrated that it is safer than the average human driver.

Maybe this is not in alignment with Brownridge, but wondering about the relationship between BTC (and other cryptos) that seem to be following the stock market moves up or down for the last couple of years in general. It seems years ago, BTC had different things that moved it. What do you think? — Mike C.

Hi Mike,

There tend to be different narratives that are assigned to each cycle between the halving of bitcoin.

In 2020-2021, its was proclaimed to be all about the egregious printing of money related to the pandemic stimulus.

In 2016-2017, the narrative was all about the new form of “internet money.”

In 2012-2013, the story was about a censorship-free payment network and the creation of new payment rails.

What will it be this time around?

We suspect that the new narrative to fuel the next big run in crypto will be tied to a very broad distrust of governments and the lies told by mainstream media. There is a global uprising against the threat of, and attempts to, take away our freedoms. Blockchain technology, and the ability to control our payments and hold alternative assets outside of fiat currencies, is attractive. As is the reclamation of our personal autonomy and independence from those who seek broad population control.

The real test will be to see what happens with bitcoin this time around when there is another financial crisis, most likely instigated by one of the wildcards that I have written about for 2024. Note — there will be a crisis.

Historically, bitcoin has been a “risk on” asset, and it has declined when the markets went “risk off.” The real question is whether or not it will be seen as a safe haven — like gold — when things get really ugly…

Hi Jeff, I was a subscriber of Brownstone Research and now I happily follow your Outer Limits notes. I thank you for your insights and foresight in technology matters which, at least for a “techno” person like me, are the most interesting. This is a simple question: Based on your opinion about Tesla, it looks like the company has still plenty of room ahead to thrive. Then would you say that it still time to invest in it? I know that you cannot give specific investment advice but a short general overview of its financial parameters could do. Thanks a lot and congratulations for doing such a good job. — Alex G.

Hi Alex,

In my investment research products, which will be coming very soon, I do provide general guidance on timing and buy-up-to prices for companies that I’m bullish on. I’m certainly keeping a close eye on Tesla, as I am long-term bullish on the company.

In the short-term, I am concerned about a market pullback, and there is definitely some major credit risk out there right now. There are a lot of things I don’t like about what is happening in the market right now, and there are large institutional outflows that could cause some problems in the broad markets.

Understanding these dynamics, as well as valuation, and predications of when growth will pick up again with EVs in general are all critical inputs to an investment thesis for Tesla. I was very happy to see Tesla make some restructuring decisions. They are always tough, and always necessary. Companies that don’t do so always end up in bigger trouble.

Mid- to long-term, Tesla has a lot going for it. August 8th is when we’ll learn more about the robotaxi plans. FSD software is just incredible now. The progress that it is making with Optimus has been phenomenal. And the market for Optimus is arguably larger than it is for EVs…

Let’s keep a close watch on developments the next few months. I will be looking for an attractive entry point.

Jeff, I think you are being presumptive about Tesla’s elimination of LIDAR, RADAR, and ultrasonic sensors. It is convenient to believe that less is more, particularly when a significant number of customers have paid for hardware and software which will result in a fully autonomous vehicle. Many of these customers have been waiting for years, thus putting Tesla and Musk at risk financially should he not deliver. The problem is sometimes less is actually less. Waymo and a host of other companies also employ some very smart technical people. Why do you assume they know less than the engineering staff at Tesla? — Rich

Hi Rich,

It’s not about the Tesla team knowing more than the Waymo team, the Cruise team, or the Aptiv team. And I’ve never written or said that…

The key difference is that Tesla took a radically different approach to its self-driving software than the other teams. The industry at large was highly critical of Musk and his team doing so years ago.

That was partly because they didn’t think it was possible to develop a vision-only system of autonomous driving, and partly because they were talking their own book. And industry suppliers also dismissed Musk and his team because they wanted to sell LIDAR, radar, and ultrasonic sensors.

Naturally, what Tesla was doing was eliminating their business opportunity.

Tesla did something radically different. It took a large risk. It may not have worked, but it did. The technology has now been proven, and the results are extraordinary and still improving with every month that passes.

Tesla developed for full autonomy, not some geofenced subset. It was a much harder problem to solve. But it made the strategic decision to invest the human and financial resources to get it done.

This was a risk taken — one that has resulted in Tesla having a clear leadership role in the autonomous driving space, and one that puts it years ahead of its competition.

In this case, less cost and less unnecessary sensors has resulted in more for Tesla…

Hi Jeff, could you provide any analysis on X.AI raise? It looks like Republic has access to it at a $100K minimum. Didn’t know if you could provide any thoughts. — Scott B.

Hi Scott,

Yes, you’re right. There is a massive raise reported to be about $6 billion for X.AI happening right now.

X.AI Corp. is Elon Musk’s artificial intelligence startup. There are a few places where accredited investors can gain an allocation, but the minimums tend to be at least five-figures.

I can’t provide any specific analysis on it, as I don’t have much information about it. Very few do, with the exception of those behind some of the very large checks from top venture capital firms.

I do know, however, that the valuation for the raise has risen to about $18 billion. How’s that for a seed round valuation?

This is what tends to happen with a name like Elon Musk and that much firepower. Right out of the gates, he can raise $6 billion at an $18 billion valuation on zero product and zero sales.

In situations like this, smaller investors are left with a few simple questions:

The answers for questions like these can only be answered by an individual investor’s own tolerance for risk and willingness to wait for a potential future exit.

I’m excited to see what Musk and his team build. I know it will be important. And we’ll definitely be following the progress closely in Outer Limits.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.