With the approval of 11 Bitcoin ETFs, what is your advice for all those that hold positions in brokerages using Grayscale Trust GBTC? Should they transition to one of the ETFs? Are all the approved ETFs pretty much equal… or are there some you would recommend over the others? — Kevin D.

Hi Kevin, thanks for writing in with this question. I figured this would come up, and I had been meaning to do an analysis on this, so you gave me a great excuse to get at it.

And the specific question about the Grayscale Trust GBTC makes the question even more interesting. There are some relevant dynamics at play that are important to know about.

For all readers’ benefit, there is some important background about the Grayscale Bitcoin Trust (GBTC). It might come as a surprise, but the Grayscale Bitcoin Trust was actually launched more than a decade ago.

The first shares were offered via private placements. And by 2015, shares in the Trust began trading publicly under the ticker GBTC.

But there has been a catch.

Up until this month, that Trust was only accessible to institutional and accredited investors. The retail market was completely left out.

It was incredibly unfair. High net worth investors, financial institutions, and hedge funds could easily trade in and out of bitcoin using the Grayscale Trust… but non-accredited retail investors were not allowed to.

The delay in the SEC approval for spot bitcoin ETFs was entirely political. I wrote a bit about this right here.

The very first application for a spot bitcoin ETF was made in 2013. It literally took a decade for the SEC to approve these ETFs, for an asset that anyone — those willing to open a digital asset account, convert fiat currency to bitcoin, and manage their own digital wallet — could purchase.

As a result, Grayscale had an incredible advantage in the marketplace.

This is what explains GBTC’s clear dominance in the spot bitcoin market, with an assets under management (AUM) of $23 billion representing almost 88% of the entire spot bitcoin ETF market. It also has the largest daily traded volume — more than half of the total industry.

I had some fun this morning working with a friend over at JLabs Digital. We were chatting about the new spot bitcoin ETF market and what’s happening behind the scenes…

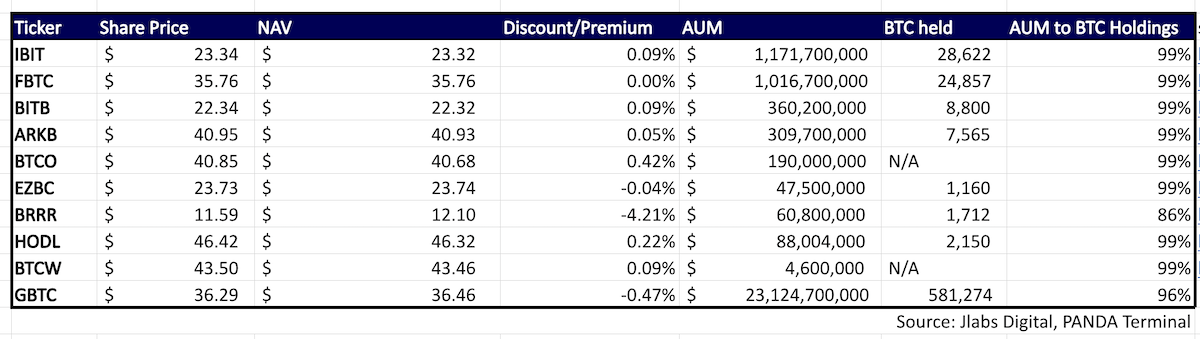

When looking at assets under management (AUM) and 5-day volume in the chart above, GBTC might look great on the surface.

BUT… that doesn’t mean that GBTC is the best one to own.

There are actually two major issues with GBTC right now.

The most obvious issue is its fee structure. At 1.5% annually, it is the most expensive spot bitcoin ETF to own. That alone makes it unattractive, but something else is going on…

There is a major exodus out of GBTC and into the other spot bitcoin ETFs. That is causing some market distortions and impacting the premium/discount to each ETF’s net asset value (NAV).

This would be an argument for IBIT (iShares Bitcoin Trust managed by Blackrock) or the FBTC (Fidelity Wise Origin Bitcoin Fund managed by Fidelity). Their fee structure is competitive after the initial wavier period (0.25%) and their volumes are healthy.

And as we can see below, their assets under management are basically equivalent to the amount of bitcoin held (99%).

Liquidity (measured by the trading volume in the first chart), scale (AUM), fees, and discount/premium to net asset value are the key things for us to look at.

For any investors who are currently in GBTC and are interested in shifting into another lower cost bitcoin ETF, the thing to watch out for is to make sure that GBTC is sold when there is a small premium, not a discount.

And when buying a new ETF, try to buy as close to a 0% discount as possible (or on rare occasions a discount to NAV).

Kevin, that’s probably more information than you bargained for. But I hope you found it useful. I think it will be beneficial to all Outer Limits subscribers interested in bitcoin.

Thank you for all the great feedback and questions. We read each and every email and address common questions in the Friday AMA issues. Please write to us by clicking here.