What a great week with a bunch of interesting topics that subscribers were clearly passionate about and interested in.

Tuesday’s Outer Limits — We’re in For More Consolidation in the Banking Sector elicited some nuanced feedback that I really appreciated. Today’s AMA is a good opportunity to dig a little deeper on the topic.

For those that haven’t had a chance to read Tuesday’s issue, I recommend doing that first.

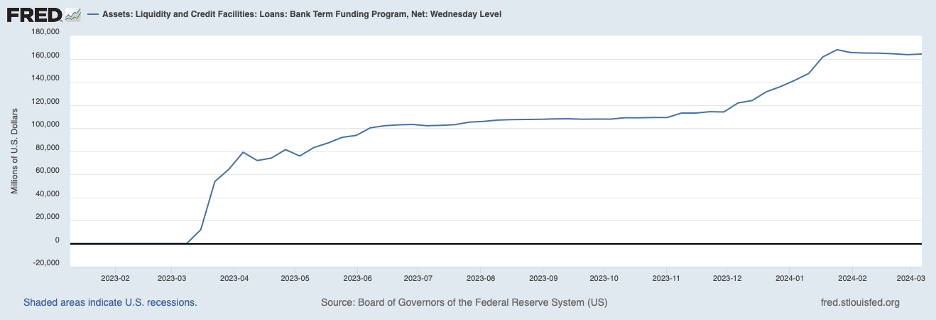

As we learned on Tuesday, the Bank Term Funding Program (BTFP) was set up as an emergency measure. The Federal Reserve put it in place to primarily save the regional banking sector from collapse, after the fall of Silicon Valley Bank and Signature Bank in early March of 2023.

The Fed provided liquidity to banks that were technically insolvent — due to the collapse in value of their U.S. Treasury bonds caused by the skyrocketing interest rates (bonds drop in value as interest rates increase).

The BTFP loaned U.S. dollars at face value (par value) of the bonds. So even if a $1,000 par value bond was now worth $500, the BTFP would provide the bank $1,000 with the understanding that the $1,000 had to be paid back.

The first ~$79 billion that was loaned out — within weeks of the program launch — was to banks that were in trouble and needed a massive injection of liquidity.

These banks were heavily exposed to interest rates due to the size of their U.S. Treasury portfolios related to their overall assets. Unfortunately, that hasn’t changed as rates are a bit higher than when the BTFP was launched.

As we look at the chart above, let’s see what happens around May 2023.

The chart flat lines… and there is only a small amount of lending going on by the BTFP. And then, roughly around December, it suddenly picks up again. Why the hiccup?

This is the part I left out.

Some banks figured out there was a very profitable arbitrage play to be had. Banks could borrow from the BTFP at the one-year overnight index swap rate… plus 10 basis points. For example, in December that amounted to 4.83%.

But here’s the thing: In December, banks could put the capital with the Federal Reserve and earn 5.40%. That’s the arbitrage opportunity. They could borrow at 4.83% and turn around and earn 5.40% in December.

It was free money for the banks… with no risk at all — and an incredible spread of 57 basis points (540-483 = 57 basis points). The beautiful part — I say this with full irony — is this was all done at the expense of the U.S. taxpayer.

Just image if we, as individual investors, could borrow $10 million from the Fed and earn 57 basis points on the spread a year. We’d all get $57,000 in “free” money a year… with no risk to us or to the Fed. We’d all sign up wouldn’t we?

I intentionally left this dynamic out as my issue was getting a bit long. But in hindsight, I should have included this information. I’d like to send a shout out to Brett H. and Dave T. for writing in and giving me the nudge, and good excuse, to “complete” the Tuesday issue of Outer Limits.

Regardless, this doesn’t make the present-day scenario any less treacherous. We’ll definitely want to watch closely to see what happens with those banks that borrowed the first ~$79 billion in the coming weeks. And on that topic, please also refer to a related question below.

Have a great weekend.

Jeff

Hi, I totally followed your logic here and wanted to see how much my banks (Ally, Vanguard, and SoFi) borrowed through the BTFP loan program to gauge the level of risk. I didn’t see a list of banks and amounts online, but then I wasn’t sure what number to compare this to to assess my risk. So I thought I’d ask you to do another article that would outline this evaluation process. — Kirsten

Jeff, I find much insight, but little investment value, in this issue of the “Outer Limits.” Should I short regional banks? If so, which? Should I buy puts on regional banks? If so, which? Your story is interesting, but useless from an investor’s perspective. I am left wanting. — Mike G.

Hi Jeff, thanks for your analysis on the banking sector. I know you mentioned NYCB, but would you be willing to list a few banks you feel may be vulnerable? Thanks. — Scott

Hello,

And thanks for the questions on this topic. You are all thinking in the right way… And yes, there is an investment angle on a subject matter like this. Great instincts, as there are definitely short opportunities in a situation like this.

Once I launch my investment research subscription products, this is the kind of setup where we would/will make specific trade recommendations. And then we would track them and advise on general entry and exit recommendations.

Outer Limits is free to subscribe, and I’d like to keep it that way. Specific, actionable recommendations will fall under my paid for research products which are forthcoming.

But I do research and write Outer Limits to also help my subscribers generate their own trading and investment ideas. Many subscribers have written in to thank me for the ideas that led to successful trades and investments already.

With that said, let’s use this as an example of what we might do. My team isn’t completely built out yet, so we haven’t had the chance to do extensive research on each bank to form any specific recommendations. We would typically spend 10-15 hours at least on a project like this, analyzing a number of banks to determine which ones are most at risk.

The information isn’t the easiest to find and it requires quite a bit of legwork to do a proper analysis. But here is an example of several regional banks that took out large loans through the BTFP.

This is not a complete list of the regional banks that borrowed that first $79 billion, but it includes many of the banks that did.

A proper analysis would require a review of the most recent financials of each of these banks in order to determine if they are solvent and have the ability to pay back their BTFP loans in full (or to whatever extent they may have paid back all or a portion of those loans).

A detailed analysis of these banks, and others, would reveal a handful that are likely in trouble.

I hope that this information is useful.

P.S. Mike, I’m left wanting too. I can’t wait to launch products with regular research recommendations. I won’t sacrifice on quality though. I need the right people and also the right technology to serve my subscribers the right way. Thanks for your patience.