It was inevitable that something major was going to break.

Looking back to March 2023 is almost a surreal experience.

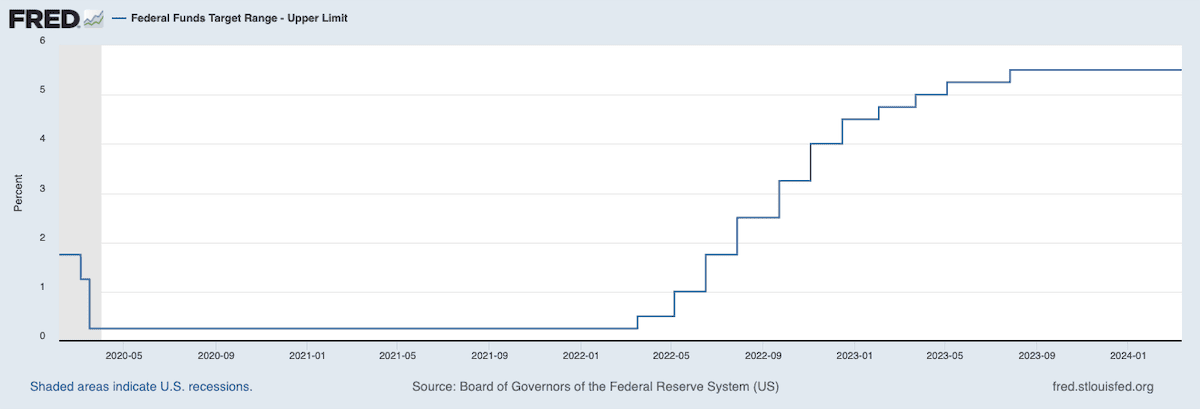

The Federal Reserve was on the tail end of the most aggressive series of interest rate hikes in history.

It ramped up the Fed Funds rate from just 25 basis points in March of 2022 to 500 basis points by the end of March 2023.

Doing that in just the span of a year destroyed the equity markets.

Investment capital fled to safety and the guaranteed returns of U.S. Treasuries.

It was the aggressive stance of the Federal Reserve than came as a surprise to most.

Firmly addressing inflation that the U.S. government created is one thing. But doing it in a way that would wreak havoc on the markets and the banking sector is another.

It’s as if “they” wanted to cause pain.

In early March 2023, Silicon Valley Bank and Signature Bank experienced a modern-day version of a bank run.

Once it leaked that both banks were insolvent, depositors raced to pull out funds before everything was shut down.

It was a disaster.

These two banks held roughly $420 billion in assets, and they collapsed in a matter of days.

Their failures became the third and fourth largest bank failures in U.S. history.

The cause of these failures was quite simple… we can see the problem just by looking at the chart above.

No one was expecting the Federal Reserve to hike rates that far in such a short period of time.

The banking industry knew that if the Fed did something that stupid, things would break badly. After all, large financial institutions — managing hundreds of billions of dollars in assets — can’t adjust that quickly to aggressive interest rate hikes.

Most banks sit on massive amounts of U.S. Treasuries as a safe way to earn interest on their depositors’ funds.

And that was the problem.

As interest rates rose, the value of low-interest rate Treasuries fell quickly.

Each $1,000 par value bond dropped precipitously. Banks were reluctant to sell them at such a large loss, hoping that the Federal Reserve would stop hiking interest rates and put an end to the pain.

But it only got worse. So bad… that it was clear it wasn’t just Silicon Valley Bank and Signature Bank that were in trouble. The problems were everywhere.

And if all the banks, large and small, started dumping their undervalued Treasuries, the entire government would fall over with global repercussions.

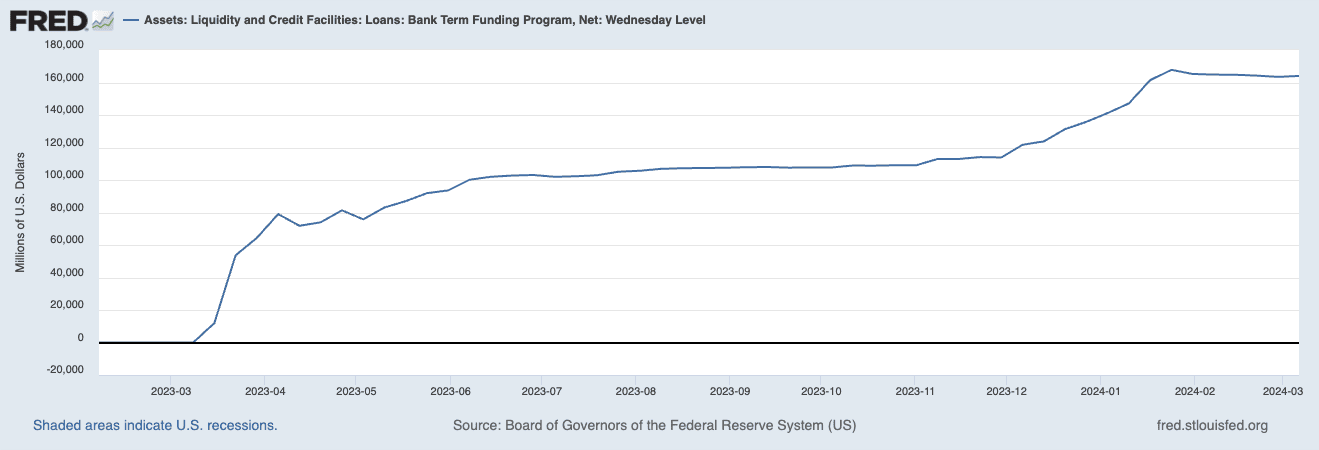

Which is why the Federal Reserve rushed to put in place a newly constructed Bank Term Funding Program (BTFP) on March 12, 2023. One year ago today.

The BTFP was an unheard-of program, designed to provide much needed liquidity into the banking industry. It was extraordinary for two reasons:

To make this program possible, the U.S. Treasury back-stopped the program with $25 billion, which seemed an incredible amount at the time. And yet, here’s what happened:

By April 5, 2023, the BTFP had already lent out $79 billion.

The term of the loans is supposed to be 1 year. Banks that utilized the BTFP are supposed to pay back the loans and receive their U.S. Treasuries that they posted as collateral in return.

One would have thought that after the initial shock, perhaps a couple months after the BTFP was put in place, the borrowing would have come to a halt.

Quite the opposite.

The demand to use the BTFP continued through early this year.

In fact, BTFP total loans peaked at $167 billion this January… and have only receded a small amount to $164 billion. That means that the problems were far worse than the Federal Reserve and the U.S. Treasury ever expected.

As a reminder, the program was expected to be $25 billion at the high end. How’s that for being way off?

Despite the more than 400 PhD economists that taxpayers fund at the Federal Reserve, they had no idea of the scale of the problem.

The banks failed miserably to hedge against the risk of rising interest rates with their bond portfolios. And the Federal Reserve clearly didn’t understand the impact that their aggressive rate policy would have on the banking sector. So much for the “experts.”

As interesting of a story this already has become, what happens next is where we’ll need to focus.

Because there is no way this ends well.

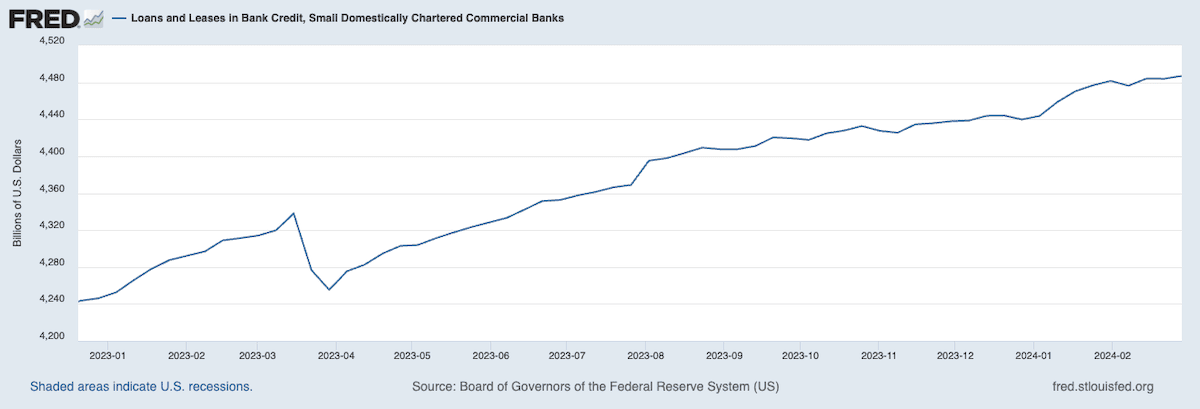

Common sense, to most of us, would have assumed that the highest-risk banks (i.e. the smaller regional banks) would have used the BTFP capital to shore up their balance sheets, raise capital by reducing lending, and prepare for the end of the BTFP one-year later, in March 2024, which is when they would have to begin paying back their loans.

What has happened might surprise us.

Despite the short pull back in March 2023, small bank lending has soared more than $230 billion.

Said another way, small banks took on more lending risk, not less.

Which is why yesterday, March 11, 2024 is so concerning.

The Federal Reserve has put an end to the BTFP lending, as of yesterday. It was only ever supposed to be in place for one year. And that day has now come.

The BTFP is being hailed as a great success, having stabilized the banking sector. It certainly stopped the collapse… but the sheer existence of the BTFP in the first place is the result of catastrophic failure of both the Federal Reserve and the banking sector.

And we can’t forget that $164 billion dollars still needs to be paid back by the banks in the weeks that follow. That first large chunk of $79 billion will need to be paid back within the next 6-8 weeks, and the rest over the course of the next 12 months.

There is one massive problem, however…

The Fed Funds rate is still sitting at 550 basis points.

Which means that the bonds that these banks used as collateral are still only worth a fraction of what they borrowed. Not only have interest rates not dropped since the beginning of the BTFP, they actually increased by 50 basis points.

In other words, the situation is more dire today than when the backstop was introduced.

So what’s going to happen now?

If we look at what’s happening to the New York Community Bank, we’ll get a hint of what comes next.

1-Year Chart of New York Community Bank (NYCB)

NYCB reported a $2.4 billion loss a couple weeks ago and the shares collapsed. Things are not looking good for the bank that took over the assets of the failed Signature Bank.

The bigger question is which banks are next?

With the BTFP lending turned off, and massive loans to be repaid, many banks won’t be able to return the funds. Many will be deemed insolvent.

Banks do have a couple of options to make up the short fall, at least for a limited time.

The Federal Reserve’s primary discount window can be used to raise capital at a cost of 5.5% for up to 90 days.

But again, that money needs to be paid back after 90 days, and utilizing the discount window presumes that a bank can generate higher returns than 5.5% while holding that capital… or, in some cases, recover enough capital to pay the Fed back.

A bank could borrow from the discount window, pay back its BTFP loan, but then it would need capital to payback its loan received through the discount window. Sounds like a bunch of left-pocket-right-pocket shenanigans if you ask me.

The Federal Home Loan Bank can also provide loans to banks, but again… that presumes that the banks are not insolvent due to their undervalued U.S. Treasury bonds, which will not recover unless the Federal Reserve dramatically drops interest rates.

And that’s not going to happen anytime soon.

I doubt it is a coincidence that the CEO of JP Morgan just announced that the Fed should hold off on cutting interest rates under the guise of unemployment being low and wages rising.

He knows what’s coming. And more small bank failures will only put more power in JP Morgan’s hands.

We’re in for more concentration in the banking sector in 2024, caused by the end of the BTFP.

The BTFP only put lipstick on the pig, and we’re about to find out how ugly the situation in the banking sector really is.

We’re in for a ride with lots of volatility ahead and more consolidation in the banking sector. It would be wise to avoid leverage at a time like this.

And it would be very smart to only hold debt with a fixed interest rate. We should expect a lot more money printing for the rest of this year. Interest rates will decline a lot less than everyone is hoping, and, in a worst-case scenario, they could even increase due to more inflation.

The vultures will be circling for distressed assets and ready to take advantage of anyone or anything that is weak. Let’s not put ourselves in that position.

And overvalued assets will be quick to fall when it all starts hitting the fan. It’s best to keep tight stops on stocks that are clearly overvalued and be ready to sell when things turn down.

New reader? Welcome to the Outer Limits with Jeff Brown. We encourage you to visit our FAQ, which you can access right here. You may also catch up on past issues right here in the Outer Limits archive.

If you have any questions, comments, or feedback, we always welcome them. We read every email and address the most common threads in the Friday AMA. Please write to us here.