What a great mix of questions this week to explore a bunch of interesting topics. Thanks to everyone who wrote in.

And whether or not you are interested in Cerebras, or artificial intelligence semiconductors, I’d like to recommend that subscribers still read at least the very first question and my answer.

It was a good opportunity to explore some of the nuances in valuations for private companies, and the differences between primary and secondary offerings.

There are also some insights around things to watch out for when purchasing shares of private companies in the secondary markets.

I hope you all find it interesting and useful.

Have a great weekend,

Jeff

Jeff & Co., Back in your old Brownstone days, you would periodically mention companies that are not publicly traded as some of the things you “watched.” One in particular was Cerebras Systems. Do you still watch them? I’m get their emails and there only seems to be good things happening, yet from what I can glean from the secondary markets, the “market price” has fallen from just a few years ago. Given that semiconductor space has been hot for quite some time, and that the AI sector has been abuzz even longer, I’m rather baffled by this observation. Do you have any insights? As you likely remember, they make extremely fast chips, but they are also quite large by comparison, and as a result tend to be more suitable for custom applications. Is this customization element holding them back? Any and all thoughts appreciated! Kind Regards. — Graham L.

Hi Graham,

Yes, Cerebras Systems is still a company that I’m keeping very close track of. I’m glad to hear that you signed up for their newsletter and have been tracking the company. This is a great way to keep track of companies of interest. That’s particularly true for private companies.

For everyone’s benefit, most private tech companies have a newsletter or blog that we can sign up for to stay on top of any interesting developments.

The below image is a screenshot from Cerebras’ landing page. Just scroll down to the very bottom, and you’ll see the button “Subscribe to our newsletter.”

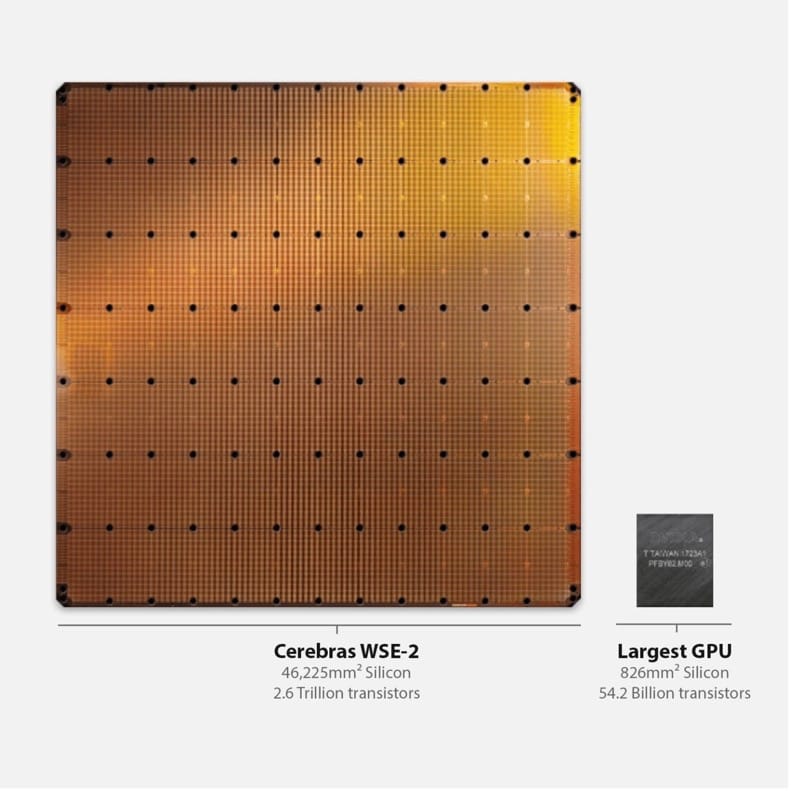

Cerebras is a unique fabless semiconductor in that its chip is the size of an entire wafer. A wafer is the material upon which the semiconductor is produced.

Cerebras uses an entire wafer, about the size of a vinyl record sleeve, to produce its semiconductor called the WSE-2 (wafer scale engine). In the picture above, we can see the size of the WSE-2 next to a typical NVIDIA GPU. Big difference.

As I’m sure we all recognize, due to the size of the WSE-2, this isn’t the kind of semiconductor that would be put in a laptop or smartphone. It’s not designed for that. This is a powerful processor designed for large datacenters, specifically to run artificial intelligence software.

Cerebras’ semiconductor design is particularly targeted at training neural networks and deep learning applications.

Graham, your question — about the “market price” for Cerebras falling despite the hot AI sector — is a good one, as there are a few interesting dynamics for us to explore.

First off, as mentioned, Cerebras is still a private company. So there is no stock chart or even a market price.

For private companies, there will be a share price and an enterprise valuation.

The share price can be a useful metric to gauge whether or not a company is selling shares at higher and higher prices with each successive fundraising round. But it’s not perfect. There is often dilution in private companies which directly impacts the share price.

And there is no stock chart to view to find out the existing share price of a private company. Only insiders/investors know that number. The only window when we can get an update on a private company’s share price is when there is a primary or secondary offering when shares become available.

The best metric to understand what a company is worth, or where it is “trading,” is the enterprise valuation. Here is an example of Cerebras’ valuation over several rounds of financings:

|

Funding Round |

Date |

Amount |

Post Money Valuation |

|

Series A |

May 2016 |

$27 mil |

$62.50 mil |

|

Series B |

January 2017 |

$25 mil |

$240 mil |

|

Series C |

July 2017 |

$65 mil |

$860 mil |

|

Series D |

November 2018 |

$80 mil |

$1.70 billion |

|

Series E |

November 2019 |

$276 mil |

$2.42 billion |

|

Series F |

November 2021 |

$250 mil |

$4.25 billion |

Source: Pitchbook

As we can see above, with each successive round of financing, Cerebras’ valuation increased to a high of $4.25 billion. It is important to note that these are primary financings. They were all priced rounds led by institutional investors (mostly venture capital firms).

Graham, what I’m pretty sure you’re referring to is what has been happening in the secondary marketplace.

A secondary offering, in the context of a private company, is when existing shareholders are willing to sell some or all of their shares to other investors.

Technically, it is not a priced round or valuation determined by a round. It is the price that the seller is willing to sell for. This is an important distinction.

In secondary transactions, one of the important metrics to understand is whether those secondary shares are being offered at a premium or a discount to the last known valuation. In the case of Cerebras, the last formal valuation was from its Series F round at $4.25 billion.

But to your point Graham, secondary shares have been trading below that last valuation… despite the hot AI market. And there’s a reason for that.

Cerebras’ November 2021 valuation was at the last peak before the Federal Reserve got so aggressive with its record number of interest rate hikes that destroyed the markets for about 18 months. It wasn’t just the public markets that were affected. The same thing happened to the private markets.

As interest rates go up, institutional capital flees to safety… and there is less demand for investment in private companies. Naturally, valuations decline from their highs. That’s what happened with Cerebras.

I checked around and found some secondary shares of Cerebras on offer right now at EquityZen, one of the key players in secondary markets. [Please note: Secondary shares are only available to accredited investors, as shares are offered under SEC Reg D regulations].

Secondary shares have been on offer at a few valuations. Some are at a $2.3 billion valuation, which is a 51% discount to the last round. Some are on offer at a $3.3 billion valuation, a 29% discount. And some are offered at a $7.6 billion valuation, a 62% premium.

How can that be? Shares at three different valuations? For the same company?!?

Welcome to the secondary markets.

All this tells us is that different groups of shareholders are willing to sell their shares at different valuations. The hard part is that without actually speaking with the executives and understanding Cerebras’ current performance and forecast for 2024 and 2025, it is hard to determine an accurate/fair valuation for Cerebras.

Not knowing Cerebras’ 2023 revenues or forecasted 2024 revenues, gross margins, and cash flow, it is hard to even determine if a $2.3 billion valuation is attractive or not. But I’m almost certain that the shares offered at a $7.6 billion valuation are way overpriced. That is probably a shareholder that is being opportunistic — if someone wants to overpay for the shares, they are happy to sell them.

Making the story even more interesting is that Cerebras is rumored to be considering an IPO later this year.

One thing that we can look for is when Cerebras files its S-1 with the SEC in preparation for an IPO.

That filing will provide us with critical information about Cerebras’ business, which will give us enough information to determine a range for valuation.

New reader? Welcome to the Outer Limits! We encourage you to visit our FAQ, which you can access right here.

If you have any questions, comments, or feedback, we always welcome them. We read every email and address the most common threads in the Friday AMA. Please write to us here.