Hi Jeff, SOOOO APPRECIATE YOUR WRITING FOR US AGAIN. Can you please recommend the best way to use bitcoin for collateral? Please breakdown the steps and best firm. MANY THANKS. — Marion

Hi Marion,

I’m thrilled to be back and I appreciate you making the effort to find me and write in.

Your question is a good one because while specific, it also speaks to an important topic in regards to wealth management, and how high net worth investors use their assets as collateral.

Using our assets as collateral can often be extremely useful, especially for short-term financing requirements.

Often, we might have assets that we can sell to raise cash, but we don’t want to sell them.

Perhaps they are assets that we believe are great long-term investments, and we want to continue to hold them. And we don’t want to sell them because if we do, we have to pay a long-term capital gains tax on that sale.

That’s where taking out a short-term loan can come in handy. Assets, like a house, can be used as collateral for a loan. I’m sure we’re all familiar with taking out a home equity line of credit.

A bank will evaluate how much equity a homeowner has in a house, as well as the appraised value of the house, and then determine what amount they are willing to lend.

It tends to be good business for banks. They’ll make interest on the loan, and essentially have a guarantee that they’ll receive their principal back as the loan is backed by real assets — in this case, a house.

And to your point, bitcoin can be collateralized in exactly the same way.

Investors who have long-term holdings in bitcoin — and want to hold that bitcoin for many years to follow — don’t want to sell that bitcoin to raise cash. They’d rather take out a loan using the bitcoin as collateral and simply pay the borrowed amount back with interest.

Before I jump into more specifics, I just want to remind everyone that I am not able to provide any individualized investment advice. The specific projects that I mention below are outlined as alternatives for borrowing against long-term digital asset holdings.

There are two key metrics for using digital assets as collateral for a loan.

LTV equals the amount of the loan divided by the underlying value of the collateral.

For many centralized lending platforms, we might see the maximum LTV allowed around 70%. And for decentralized lending platforms, the LTV can exceed 100%.

One key point, however, is that while the loan value remains the same, the underlying value of the collateral — bitcoin, in this case — can be volatile.

After all, bitcoin — or any other digital asset — trades daily and can experience price volatility.

If the LTV exceeds the maximum LTV, an investor would receive a margin call or have their assets liquidated to immediately pay back the loan. It is important to watch the LTV ratio closely for that reason.

One of the common centralized platforms for collateralized lending is SALT Lending.

SALT currently has 12-month loan terms and makes both business and personal loans. Anyone interested would need to look into SALT’s ability to lend in their specific jurisdiction. It can be different from country to country, and from state to state.

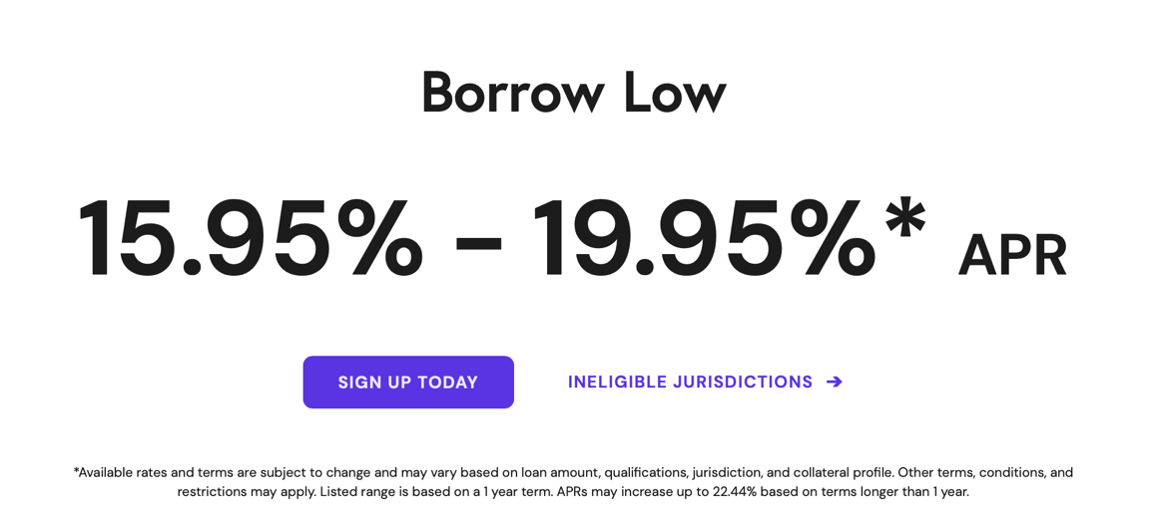

For this service however, the interest rates charged can be high presently. The below image was taken from the SALT website today.

Obviously with an APR that high, this kind of loan is better to be short-term, otherwise the interest expense will become a real burden.

SALT Lending is probably the most consumer friendly of the options, as others are increasingly more technical.

THORChain is another option that will lend against bitcoin and ether holdings in dollar denominated debt.

The disadvantage of using something like THORChain is that it is necessary to open, manage, and close loans using decentralized exchanges. This adds another level of technical complexity to borrowing against digital assets. For those interested, you can go here for more information.

Two other protocols for collateralized loans in the blockchain industry are Aave and Compound. These are great projects, but very technical, and someone would have to be very savvy to feel comfortable using these protocols.

Information on borrowing using Compound can be found here. And information on borrowing using Aave can be found here.

One final point. When a digital asset is collateralized, the loans are typically issued in some kind of U.S. dollar stablecoin. If the use of the loan is to invest/trade in other digital assets, then that’s easy to exchange those stablecoins for other digital assets.

But if the need is to convert the U.S. dollar stablecoin into U.S. dollars (fiat currency), it is important to take into consideration the costs of converting from digital to fiat, and then from fiat back to digital when the loan is to be repaid. There is quite a bit of friction in those conversions

Hopefully that provides everyone with some ideas and options for collateralizing long-term digital asset holdings.