My apologies for a very late AMA. Some heavy travel and work related to special developments — that are forthcoming — kept me from publishing on both Thursday and Friday. You didn’t miss anything, I just wasn’t able to get my research out. And I won’t compromise on quality.

I have been working very hard in the background on affecting the best possible outcome for both past and present subscribers of mine. It hasn’t been easy, and I appreciate everyone’s patience. I believe the wait will be worth it. I’ll provide an update as soon as I can.

Last week was a big one, with major announcements from both OpenAI and Google.

We covered OpenAI’s launch of its new multi-modal generative AI, GPT-4o, in Outer Limits — Is Google Doomed? I’m still thinking about the implications of this new product release.

It’s clear that OpenAI has set the stage for something far more powerful in the coming months. We’re in for another major surprise.

And we also explored Google’s efforts to catch up with OpenAI in Outer Limits — Google’s End Game. Google has both the money and the technical resources to catch up to OpenAI in the next 12-18 months.

And they aren’t the only contenders.

We’re witnessing the race to artificial general intelligence (AGI). It’s a race that could be won as early as next year, but certainly by 2028, which has been my own personal predication over the last decade.

It’s hard to believe that it is all happening right now at such a torrid pace.

Lots more to come.

Jeff

Hello Jeff (and Lindsey — are you real BTW?). Seriously, I’ve read the last two letters in Outer Limits summarizing AI with both Google (Gemini) and OpenAI (GPT-4o) — fascinating stuff. My questions pertain to xAI: What is the status? I’m assuming startup basis — if so, would you invest if there was an avenue? Love your Brownridge work. Best. — Felix E.

Hi Felix,

First and foremost, yes, Lindsey is very real and I’m lucky enough to have her as a co-founder of Brownridge Research. While we’re working on the outer limits of what’s happening in the world with technology, and we are very much tech-enabled, our intelligence is very much human…

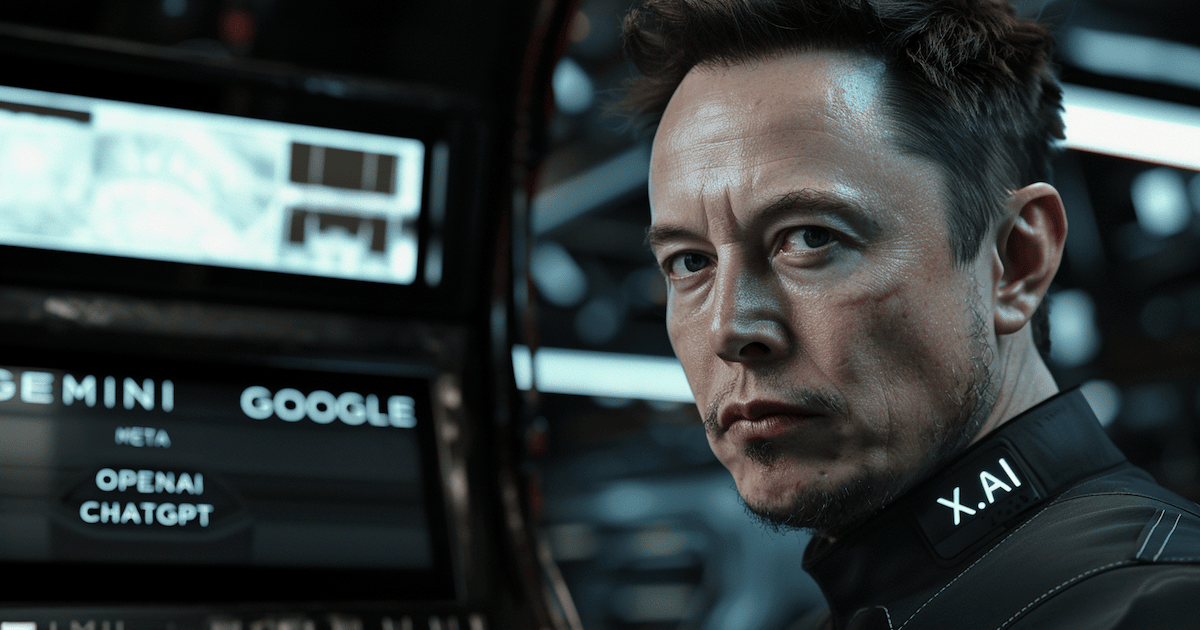

xAI is the company behind Grok, a foundational large language model (LLM) currently available on Grok. According to its website:

“xAI is a company working on building artificial intelligence to accelerate human scientific discovery. We are guided by our mission to advance our collective understanding of the universe.”

Elon Musk and his team’s efforts at xAI are extremely important for the world, as they are building an AI that is neutral, and not programmed with ideological bias.

This month, xAI is raising $6 billion at an $18 billion valuation as a startup. This is, of course, highly unusual to raise this kind of capital at that valuation for a company that has only been around for a few months. But with a name like Elon Musk behind the company, it’s possible to do so.

I have seen opportunities for accredited investors floating around during the raise, so it is possible to invest.

But to your question, would you invest?

The real question is whether or not we believe that xAI will be worth more than $18 billion years down the road. Will it be worth $100 billion? That would be just a 5.5X return. Or $50 billion, just a 2.7X return? Or more?

And how long will it take to exit? Musk has been quite vocal about the disadvantages of being a public company. He strongly prefers private companies. And none of his private companies have paid dividends or distributions.

For example, SpaceX is more than 20 years old, has never paid a dividend, and is worth $180 billion now. And there isn’t even a rumor of the company going public. Without an exit, the only way private investors might be able to capitalize on their paper gains would be through a secondary sale of shares, which would need to be approved by the company.

Would we, as investors, be willing to wait 20 years for a 5.5X return on xAI?

I’m asking these questions as an exercise. Each individual investor needs to understand both their risk tolerance, their time frame, and whether or not the risk/reward is suitable for them. It can also be useful to speak with a financial advisor — as a sounding board who better understands our complete financial picture and plans — when considering an opportunity like this.

It’s possible to be bullish on Musk and his team at xAI, and also see this as an unattractive investment opportunity. If shares were on offer at a $1 billion valuation, that would be far more attractive than $18 billion, and still have the potential for a 100X return.

As for the status, Felix, xAI has already developed and launched Grok in a very short time frame, and is already working on the next iteration of the technology.

xAI will act as a critical counterbalance to the biased AIs being developed by Alphabet (Google), Meta (Facebook), and OpenAI. We’ll continue to track its progress closely.

I see you talk about a lot of subjects, but I do not see any recommendations. Am I missing something? Do you have a newsletter that I have not seen? — John O.

Hi John,

Thanks for writing in with your interest. And no, you aren’t missing anything. And your instincts are correct.

I will soon be launching, and re-launching, investment research publications that have specific buy recommendations in both private and publicly traded securities and digital assets.

I’ve been working intensely behind the scenes to do so and am very close to some major announcements. I appreciate your patience.

I will, however, say that Outer Limits, and my former daily publication The Bleeding Edge, are a critically important part of my overall investment research and analysis. There are simply too many developments on too many topics that directly impact our investment opportunities.

This includes monetary policy, fiscal policy, geopolitical policy, and of course all of the developments in technology and biotechnology. There is no way for me to cover that much ground with a once-a-month premium research publication. It’s important that we stay on top of these developments daily so that we are prepared and have the framework for making good decisions for ourselves. That’s what we do in the daily.

My hope is that through Outer Limits, we can develop a solid understanding of the landscape of various sectors, which will better inform individual investment decisions. That way, when an opportunity presents itself in a certain sector or asset class, we won’t just be hearing about it for the first time. We will already have a reference point and understanding from which we can build upon.

I often say that Outer Limits contains some of my most valuable insights and information. While I don’t specifically make buy/sell recommendations in it, a clever reader can absolutely get a window into my research at any given point in time, see where the puck is headed… and glean actionable investment ideas from my analysis.

More to come very soon…

Hello Lindsey and Jeff, Glad I found you again. I used your crypto service in Brownstone Research (a neural network that finds patterns), and I’m still fascinated from the work you do. I’m 32 years old living in Bulgaria. I have competed professionally in volleyball for many years, but now it is time to change my path. I’m looking carefully for the information you provide and would like to bring some of the technology to my country. Recently, I brought a Biocharger NG to my country as it relates to good health and I think you might like it. I have a question: What would you advise me to study onward? I have a passion in the field of health and good performance, also four years’ experience with crypto (researching projects for investment and separately trade daily). I haven’t coded before, but I think it would be useful in time. Since Jeff is the best in his field and he is a good man (I remember one of his early 5 o’clock updates when the markets were not doing well and he was genuinely worried about his followers), I have total respect for him, and if he could give me advice for different courses to take I would appreciate it. Thank you, Lindsey and Jeff. — E.G.

Hello E.G.,

Thanks for writing in. I have always found changes in career an exciting time to explore something new and interesting.

And while I don’t know all of your specifics, your instinct about coding is great. You’re still young and it’s not too late to catch up with the latest developments in software, and coding is one of the single most valuable skills that anyone can have right now.

And with the latest developments in artificial intelligence, knowing how to work with software/programming has become a vital tool, and one that is valued by employers.

Irrespective of the field we might enter, the utilization of software, programming, and ultimately AI will be skills that will remain high in demand.

I’m not sure about Bulgaria, but in the U.S. coding bootcamps are very popular. Some of the most well-known are General Assembly, Flatiron School, Galvanize, and Fullstack Academy. I know that there are similar bootcamps in Europe which would be more convenient to you.

Most of these schools have intense, 3-month programs that help us build a foundation for software programming, upon which we can use to specialize in certain areas.

For example, the use of AI software will become modularized… whereby we’ll use AI tools and software packages that we’ll incorporate with data in order to optimize some process or gain some insights.

Understanding how to work with software code and programming languages will empower us to work with these emerging technologies.

I hope that is useful and if gives you a few ideas.

Best wishes in your new career path.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.