What a great bunch of questions on a diverse range of topics this week. Thanks for the engagement. I tried to hit all of the most popular themes.

Autonomous driving was obviously a big theme this week given recent developments. It is something that is happening far faster than most think. And we’re going to see some incredible developments in the 2nd half of this year, particularly with Tesla on autonomous vehicles — and not just vehicles, but robotics too.

We’ll have very big news to share with subscribers in the next couple of weeks. The team — my team — is back together and stronger than ever. It was a lot of work, but starting next week, as you’ll soon discover, it’s go time!

Most importantly of all, for my loyal subscribers, it will be worth the wait.

More to follow,

Jeff

Thanks for the always interesting and informative info you provide in Outer Limits. My question: what’s going on with crypto right now? I’ve been expecting big moves since mid-April, but BTC and ETH are both in the toilet! What caused crypto to drop versus take-off after the Bitcoin halving and all the Blackrock customer expansion that was supposed to drive crypto up? — Michael M.

Hi Michael,

To start off, and to make sure we’re all on the same page, let’s understand the Bitcoin halving that you mentioned.

When a bitcoin miner completes a block of the bitcoin blockchain, the miner receives a reward. The halving refers to the time at which the reward that the bitcoin blockchain issues is cut in half.

This is something that is literally part of the bitcoin blockchain’s programming — it’s written into the code. And it happens about every 4 years.

In general, in the 12-18 months prior to every bitcoin halving, the price tends to bottom out, and then it climbs higher into the halving. And then what normally happens is the price takes a breather for a while.

What we’re seeing now is similar to what we saw in 2012, 2016, and 2020. Nothing unusual at all.

The other dynamic that came into play was the impact of the launch of several bitcoin ETFs.

There was clearly a run-up in prices leading up to the expectation of the ETF approvals.

Related to that is a topic that hasn’t been discussed much, but it had a real impact on the price of bitcoin and other digital assets. With the run-up in prices, there was a corresponding increase in volatility. And when volatility increases, so do the value of options.

What we saw was a massive amount of selling of call options into the market. Those that were bullish on BTC and ETH were aggressively buying call options, thinking things would keep going higher. And those that believed the prices would pullback and volatility would drop were happy to sell them the call options.

All of this activity ultimately suppressed volatility, which dropped dramatically. And those call option sellers were very profitable. This also put a damper on the price action.

The reality is that when there is enough institutional capital putting on specific kinds of trades, it can impact price action of the underlying asset for a period of time. The effect won’t last forever, but it can impact trading for several months.

Understanding these dynamics can help us normal investors decide what we want to do with our own investments (i.e. trade off it, stay on the sidelines until it passes, or hold on for dear life (HODL)).

To finish on a positive note, the best gains tend to come after the halving has been digested, and everyone gets back to business.

Subject is Anthropic. They had some interesting news recently (I think I heard via CNBC). They’re an AI “security” firm of some sort, are private and have raised a considerable amount over time. It was something related to unlocking AI “black boxes” (I think), but I unfortunately don’t fully understand the significance. Can you provide some insights? Thanks. — G.L.

Hello G.L.,

You’re right, Anthropic has definitely had a bunch of interesting news recently.

It is definitely not a security firm though. Anthropic is one of the leaders in building a foundation model for artificial intelligence (AI). It’s latest large language model (LLM) — Claude 3 — is one of the leading LLMs in the industry, competing with OpenAI’s GPT-4, Meta’s Llama 3, Google’s Gemini 1.5, and X’s Grok 1.5.

Anthropic is much more neutral (i.e. less ideologically biased) as compared to OpenAI and Google. And it talks a lot about AI “safety” as a selling point. That’s not at all to confuse safety with security or cybersecurity.

I’m not sure about the comment with regards to “black boxes,” but this term is often used when referring to deep neural network (DNN) technology. Some think of these DNNs as black boxes because while we can understand the inputs and the outputs, we don’t know exactly why the AI makes the decisions that it does.

Anthropic is a company to watch. It just raised $4 billion at an $18.4 billion post-money valuation. It now has the funding to develop new foundation models and compete in the race towards artificial general intelligence (AGI).

How will we be able to support the continued increase of electric load demand on our grid? — Justin P.

Hi Justin,

It’s kind of amazing that so few talk about this issue. “They” just parrot that we should all switch over to electric vehicles, heat pumps, and electric stoves. Everything will be just fine — mission accomplished.

They ignore where the electricity comes from — the majority is from fossil fuels. And they ignore how it gets distributed — anywhere between 7-15% of all electricity is lost through transmission from the power plant to the home or business, along the transmission lines.

And to your point, the current power grid could not support the increased electricity load if everything went electric.

The real problems are stemming from the reality that transmission lines have about a 50 year lifespan, and more than 70% of all transmission lines are more than 25 years old. And large power transformers, which have a lifespan of 40 years, are responsible for about 90% of U.S. electricity.

This is just an example of one country, but just about every developed country is facing the same critical problem: an aging power grid that needs to be upgraded and modernized.

I’ve seen one estimate that about 140,000 miles of transmission lines already need to be replaced in the U.S. Between now and 2050, I’d estimate that somewhere between $2-3 trillion needs to be spent to upgrade the U.S. national power grid.

If we truly want a clean and peaceful environment (I for one do), the government needs to stop starting wars and pandemics, focus on nuclear fission and nuclear fusion for baseload clean energy production, and modernize the national power grid.

Let’s hope common sense and rational thinking prevail.

I’ve owned a Tesla model 3 for a bit over a year and paid for the FSD beta as soon as it was available. Like you, I have been extremely impressed with the technology. I am curious, however, about how Tesla will address using only cameras when there is rain or snow. I live in a northern climate and while I haven’t had to drive in snow or ice conditions yet, I have noticed the constant warnings about degraded FSD in rain. It has only disconnected once in heavy rain but it begs the question when Tesla goes fully autonomous, what’s the plan? Thanks. — Taylor P.

It seems to me that the EV limitations due to battery cost (replacement), cold temperature and fire/explosion problems, charging stations, time (unless done by a service), source electricity for requirements, and heaters would indicate a hybrid would be a better option than an EV. Sure missed you so I gave up my total Lifetime subscription at Brownstone! Don’t know how you can keep up your schedule! Plan to ease up by overseeing? Thank you for whatever you want and can do! — Knox M.

Hello Taylor and Knox,

These are great points to raise, as they are real world scenarios outside of the highly unusual dry and temperate climate of most of CA.

Personally, I’ve had no problem with my Tesla driving me using FSD in rain or snow. Whenever the weather is bad, I’m crazy enough to go out and test it. One way we can think about it is that the cameras around a Tesla are like our eyes. If we can drive in bad weather, so should the Tesla be able to.

The reality is that the Tesla is better equipped than we are to navigate in these conditions.

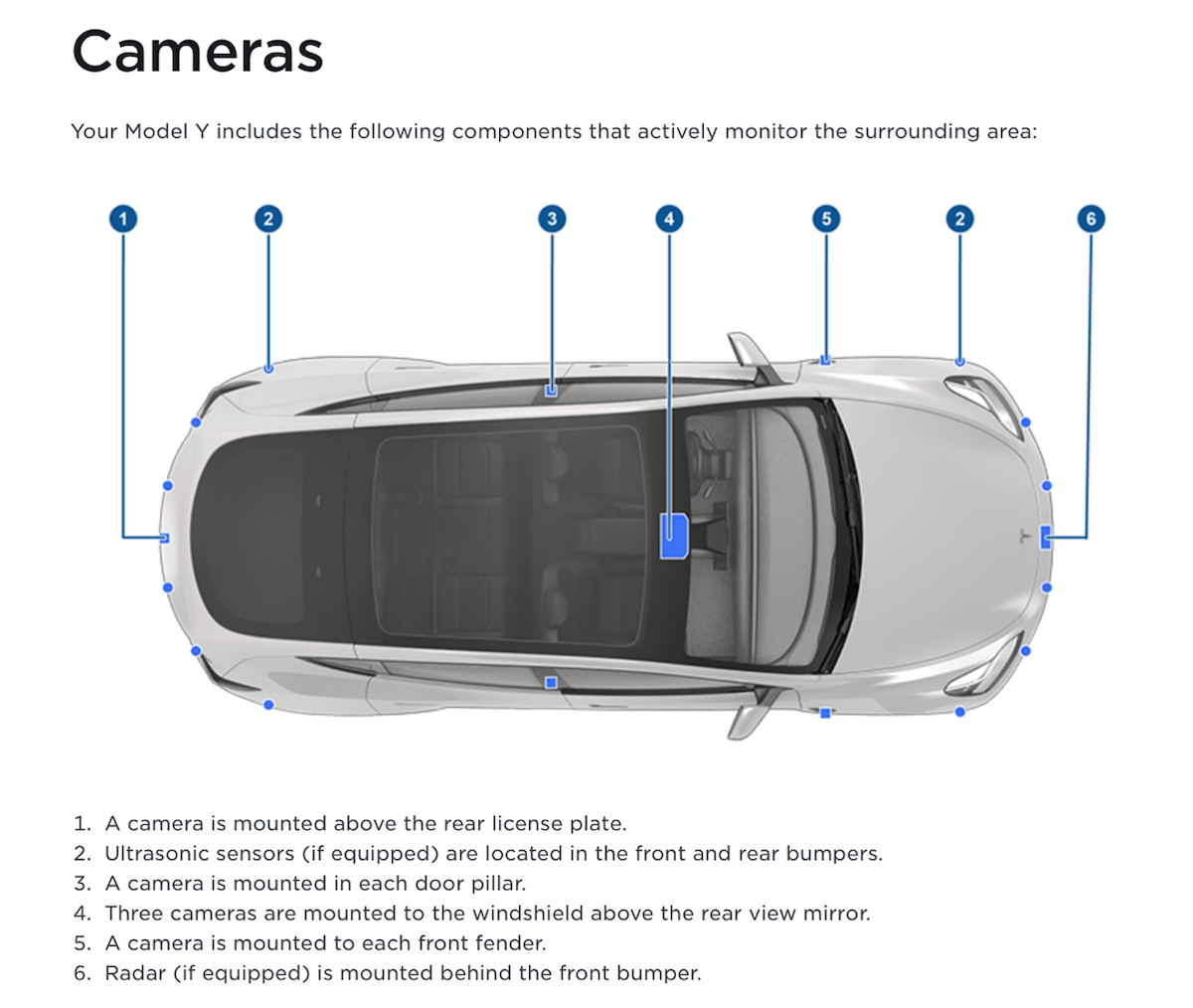

Our eyes have a limited range of vision. If we look at a Tesla above, it has eight external cameras and some ultrasonic sensors to “see”. It maintains 360-degree “vision,” which is impossible for us humans to do at any given time.

Another way to think about this is if we are in an environment that we can’t navigate, what do we do? We pull over and wait it out. This happened to me earlier this year. I was at a hockey tournament in Buffalo this January, and there was a massive snow storm. It was a complete white out on the roads at times. The snow was so heavy, and the wind was so strong, that I had to pull to the side of the road for a while.

And when conditions are that bad, the Tesla would simply have to disengage and return driving to the driver to find a safe place to wait things out.

And Knox, EVs definitely have their issues. First off, they’re not clean. Their carbon footprint is far larger in manufacturing compared to an internal combustion engine vehicle, primarily due to the metals needed to produce the EV batteries.

One study showed that an EV has to be driven 60,000-70,000 miles before it recoups the carbon used to making the car and batteries putting it on equal footing with a normal car, but that assumes that the electricity used is from something like solar. EVs that use electricity from coal and natural gas have larger carbon footprints that normal cars.

The other points that you mentioned — like battery cost replacement, fire/explosions of batteries, cold temperatures, and charging stations — are all issues that are improving every year. Battery costs are declining, and the technology gets safer. EV batteries can be pre-heated before driving in cold temperatures. And charging stations continue to be built out every year.

But you’re right, having a hybrid is like having a backup in your car. I think hybrids made more sense a few years ago when the industry was still maturing, but they provide less overall value today. As all of these dynamics continue to improve, there will be less demand and utility for hybrids.

As for your last question, I don’t have any plans at the moment to slow down. In fact, as you’ll learn in the next two weeks, I’m about to speed up. There are too many exciting things happening right now, I can’t imagine sitting on the sidelines. There will be plenty of time for that years down the road.

I’m fortunate to have a great team around me that I have worked with for years, and we’re ready to build again. Having the right people, and carefully growing my team, will enable me to do even more for my subscribers.

And that’s the plan.

I read Jeff’s article “Your Robotaxi is Arriving”, and took note of some statistics on the last page regarding the “urgent need for the technology.” I live in an upscale, mostly retirement aged community. I say mostly because it is not restricted to retirement age residents. Out of nearly 4000 residents, there may be 25-50 EV owners (guestimate) who are daring enough to buy a high-technology car like a Tesla. I am one of them. I am constantly in discussion with fellow residents about the utility of an automatic self-driving (ASD) car. Almost everyone I talk to doesn’t acknowledge the need. Three days ago, I received a 30-day trial of the latest Tesla ASD software. What is it going to take to convince my neighbors that it is safer to drive than the car that they are now driving? — Robert B.

Hi Robert,

What an important use case you raise.

In any aging community, driving becomes more and more dangerous. As we can see below, fatal crashes start to jump higher at 75 years old and spike from there.

This is where autonomous driving technology could be so helpful. Not only will it save lives, it will allow those who can’t drive anymore to have the same level of mobility and autonomy that they had when they were driving.

The first thing that needs to happen is that a company like Tesla needs to gain regulatory approval for a full self-driving robotaxi network. This will solve a major problem in terms of acceptance and availability of robotaxis.

Next, it will gain regulatory approval for Tesla owners to opt-in their cars into a ride hailing network (i.e. the cars can go to work for them).

Eventually, Tesla will get regulatory approval to sell and market “fully autonomous self-driving cars.”

And given my predictions in Outer Limits — Tesla Hints About the Future of Transportation, these things have the potential to happen within the next two years.

With just a little bit more time, and intelligence that will come from having driven 6 billion miles on FSD, the safety data that Tesla will be able to demonstrate will be remarkable.

Advanced mobility for those who are advanced in age will become normal.

Hi Jeff, can you please comment on Akoustis (AKTS). The stock doesn’t seem to get a break from falling. Many thanks. — Lorraine

Hi Lorraine,

What’s happening with Akoustis is a real mess right now. I feel bad for the team at Akoustis, as I believe that a larger tech company is taking advantage of a small company and its financial position. I’ll dig into what’s happening right now.

First of all, Akoustis has been on an incredible run in terms of progress with its product development and design wins. Design wins are the lifeblood of any semiconductor company. A semiconductor company develops business by designing its semiconductor into an electronics product. And when that product goes into production, Akoustis generates sales.

There is a lag time between design wins and sales, especially as it pertains to consumer electronics, and that can create cash flow problems, especially for smaller companies. Akoustis has historically filled in those gaps with secondary offerings of its stock. The company is on track to reach cash flow breakeven by the end of this year, which is an incredible milestone.

The “mess” that is happening right now is that a larger semiconductor company, Qorvo, has sued Akoustis for the use of its intellectual property regarding BAW filters. Qorvo is a $10 billion semiconductor company that is sitting on $1 billion in cash (i.e. they have a ton of resources that they can use in a lawsuit).

A jury recently decided in court that Akoustis was violating its patents. This decision opened the door for Qorvo filing an injunction against Akoustis for the products that are believed to be using Qorvo’s intellectual property.

One of the more interesting dynamics of this whole circus is that Akoustis CEO Jeff Shealy spent 13 years at RF Microdevices (RFMD). And in 2015, RFMD merged with TriQuint Semiconductor and formed Qorvo. There is history there…

Where it gets interesting is that Qorvo sued Akoustis for what I consider to be fairly generic patents related to bulk acoustic wave (BAW) resonators. They weren’t related to the areas where Akoustis has a dominant intellectual property portfolio, they were more generic in nature.

And get this, one of the two patents (U.S. Patent# 7,522,018) expires on October 29th of this year. Why bother?

And why would Qorvo be attacking such a small company like Akoustis, which is currently a very little threat to its $10 billion business? Especially with generic patents, one of which expires later this year…

I’ll share with you what I think is happening. And to be clear, I’m speculating based on the information that I have, but I’ve seen this kind of thing before.

Qorvo has clearly been trying to damage Akoustis’ business and make it spend time and money on such a ridiculous lawsuit. The jury awarded Qorvo a total of $38.5 million in damages to Qorvo.

First, the amount awarded is tiny compared to Qorvo’s $1 billion in cash. In other words, it wasn’t about the money. And second, I have to wonder if the jury had the expertise to understand the intellectual property nuances regarding bulk acoustic wave filters. But I suspect that was by design.

I’m not going to comment on whether or not Akoustis did or didn’t do anything wrong. I don’t know. I do know however that Qorvo could spend a lot more on lawyers than Akoustis could reasonably do.

But it is clear that Qorvo was trying to drive down the valuation of Akoustis and inhibit its ability to conduct business with its unique filter technology.

Why?

Well, my best guess is that Qorvo wants to acquire Akoustis and its intellectual property on the cheap.

The fact is that Akoustis has technology that materially improves the performance of electronics devices over wireless networks. And Akoustis did such a good job patenting its own technology, that larger semiconductor companies are not able to produce products without infringing on Akoustis’ patent portfolio.

And now that 5G networks have been widely deployed and Wi-Fi networks are operating in higher and higher frequencies, Akoustis’ technology is much in need. And we can see that from all of Akoustis’ design wins. Akoustis may have been early to the game with its technology, but the market has come right to its doorstep.

I believe that the whole lawsuit is a ruse to force Akoustis into a fire sale to Qorvo. I’d actually be shocked if discussions aren’t happening right now.

To Akoustis’ credit, it planned well in advance for an adverse decision from the jury. On Wednesday, it announced that it already updated its manufacturing processes to remove any patented features claimed by Qorvo. Doing so removed any patent infringement.

Concurrently, it just raised another $10 million dollars giving it runway to make it to cash flow breakeven. This buys Akoustis some time, and most importantly strengthens its negotiating position with Qorvo.

Akoustis is worth so many multiples above where it is trading right now. The real question is whether or not Qorvo will step up and offer something reasonable that the Akoustis board will accept.

And on that point, your guess is as good as mine…

I’ve long hoped that Akoustis would remain an independent semiconductor company and grow to a billion-plus-dollar valuation, but I’ve always acknowledged that it would be a likely acquisition target.

If I’m right about my speculation, I hate to see these kinds of cutthroat tactics happening to such a great team/company.

But in the world of intellectual property, I’ve seen tactics like this before, and it sure looks like this is what is happening right now.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.