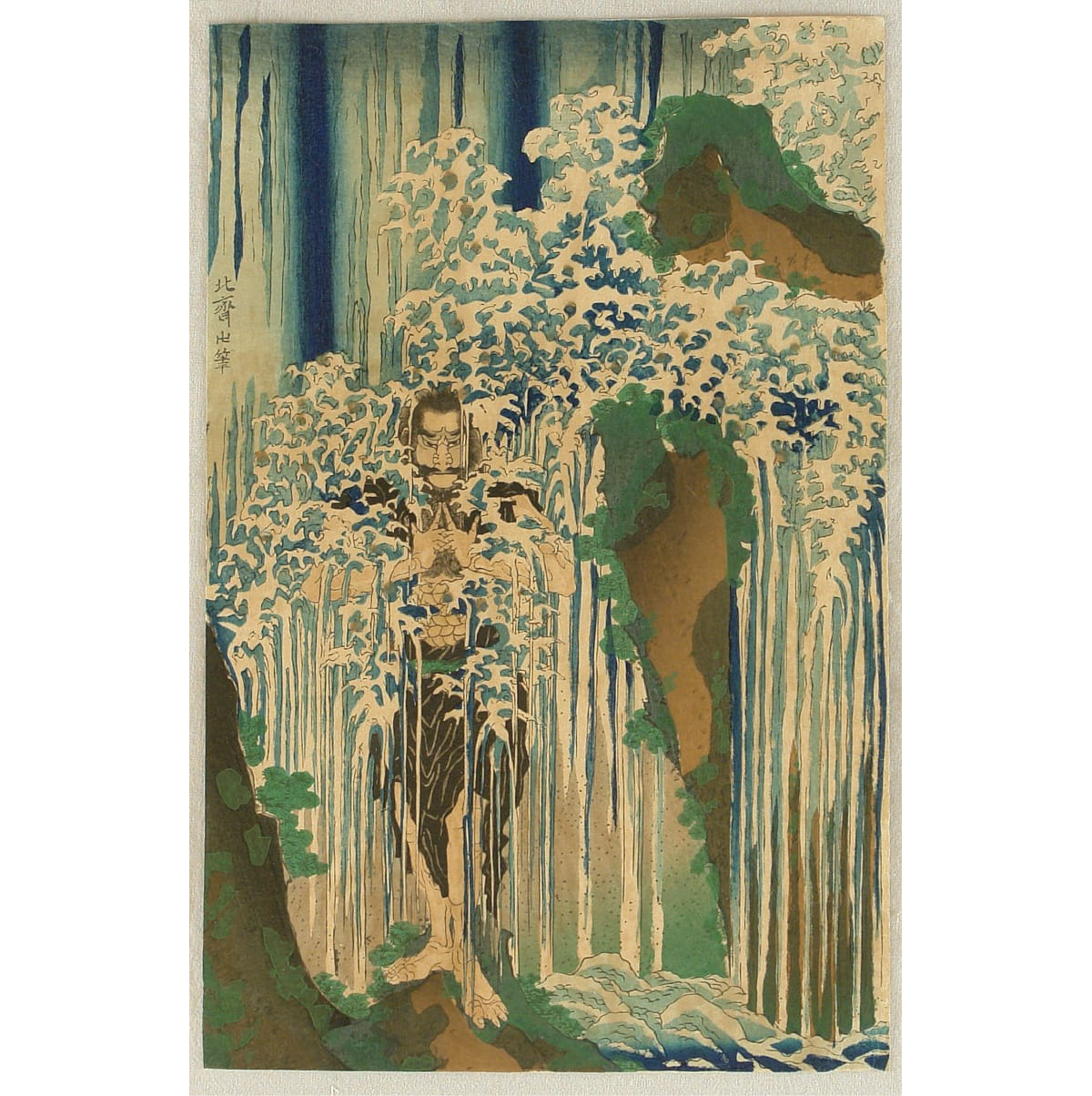

The Shinto ritual of misogi (禊) is not for the timid.

Standing or sitting under a frigid waterfall and clearing the mind in hopes of achieving a state of calm and cleansing oneself is not easy.

I’ve tried it myself a couple of times. It’s much harder than a cold plunge. It’s the constant rush of the cold water that makes it more difficult.

It’s not supposed to be easy, though, as the purpose of misogi is not inconsequential. The frigid water is meant to wash away any impurities, evil, death, and bad experiences of any kind.

The evening bath at the end of a long day in Japan serves a similar purpose, albeit one that is far more comfortable.

The father of this cleansing ritual is known as Izanagi (伊弉諾尊). Shinto is the native religion of Japan that revolves around gods — kami (神) — that exist in all things. And Izanagi is one of the Shinto gods known for creating the islands that constitute Japan.

It is also the code name for yet another audacious plan from Softbank’s CEO Masayoshi Son.

Longtime readers recall that Softbank is a Japan-based multinational conglomerate holding company. It has also oddly become one of the largest tech investment firms in the world.

Softbank’s new project — Project Izanagi — is planning on raising $100 billion for the purpose of creating a semiconductor company capable of producing artificial intelligence (AI) specific chips.

We explored another similarly audacious plan recently in Outer Limits — The $7 Trillion Investment of a Lifetime earlier this month.

That project, led by OpenAI CEO Sam Altman, is to raise $7 trillion to fund the construction of bleeding edge semiconductor plants located in the U.S. and other Western markets to improve supply chain stability and meet the explosion in demand for AI-specific semiconductors.

Softbank’s $100 billion target raise, of which it will contribute $30 billion, may seem paltry in comparison to Altman’s $7 trillion target. But for Softbank, it’s not.

Softbank raised $98.6 billion in 2017 in its Vision Fund I and an additional $56 billion in its Vision Fund II in 2019. In 2017, that was the largest technology venture capital (VC) fund raised in history. So large in fact, that it greatly distorted the entire VC industry.

With so much money to deploy, Softbank would chase deals at absurd valuations. Softbank’s capital made it hard for traditional VCs to get deals done at reasonable valuations. It pushed tech valuations higher, and even made tech M&A (mergers and acquisitions) activity difficult, as buyers and sellers struggled to find a mutually agreeable price.

Softbank became somewhat infamous as a result. It invested in train wrecks of companies like WeWork at absurd valuations which ultimately imploded.

Many of the companies that ended up in the Vision Funds are strong companies, though…

The problem was that Softbank way overpaid for just about every one of them.

This resulted in extraordinary write-offs by Softbank in the years that followed. For its fiscal year ending March 31 last year, Softbank’s Vision Fund lost $32 billion. The fiscal year prior was a loss of around $21 billion.

It’s hard to comprehend losing that much money, especially when the funds were supposed to be placed in the hands of “experts” and PhDs in their fields. But the team at Softbank managed to do it — they must have worked really hard at it.

One exception, however, was ARM Holdings.

Acquired by Softbank in 2016 for $31.4 billion, it was a massive acquisition.

And yes, Softbank overpaid for ARM at the time. $31.4 billion represented about 21-times annual sales, more than double what I would have considered reasonable back then.

ARM is a gem in the semiconductor industry, though. It designs semiconductor architectures and licenses its designs to semiconductor companies. This is a high-gross margin business.

ARM has always specialized in power-efficient designs for smaller semiconductors most often used in electronics applications where power consumption is important.

It took years for ARM’s valuation to catch up to what Softbank paid, and by 2020 NVIDIA offered $40 billion to acquire ARM… which would have eked out a decent profit for Softbank, which at the time was hurting for cash.

The deal fell through, however, due to regulatory concerns over NVIDIA becoming too powerful in the semiconductor industry. This was a disaster for Softbank at the time, but it turned out to be a blessing in disguise.

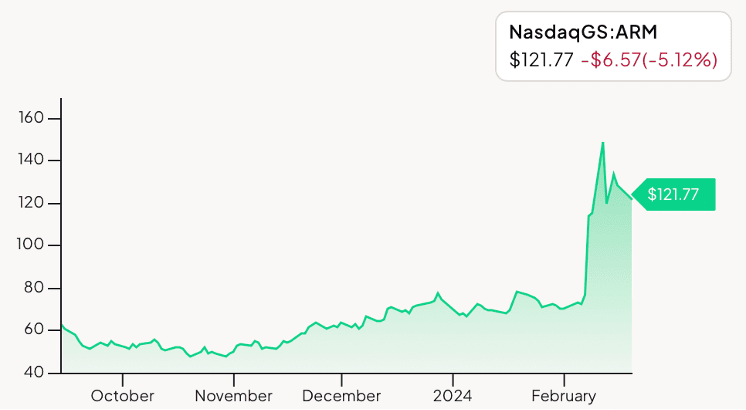

Softbank sold 10% of ARM in an IPO on September 14, 2023. The chart below shows that Softbank’s patience had paid off.

6-Month Chart of ARM Holdings (ARM)

ARM now trades at a $123 billion valuation and an enterprise to sales (EV/Sales) ratio of 41.

That puts ARM at almost the same EV/Sales as NVIDIA — nosebleed levels.

The reason, not surprisingly, is that many of ARM’s semiconductor designs are applicable to AI applications, especially those that run AI at the edge of networks.

As artificial intelligence applications proliferate onto more and more consumer electronics devices, ARM’s revenue from licensing fees will continue to grow.

Which is why, despite Softbank’s checkered venture capital investment record, it will likely succeed in going out and raising a record $100 billion fund to build the “next NVIDIA.”

After all, the allure of investing in what could become the next trillion-dollar company is too great right now.

Softbank will plunge into the AI waterfall… and likely invest $100 billion into a single venture designed to compete against the $1.7 trillion NVIDIA — the most valuable semiconductor company in the world.

It doesn’t need Sam Altman’s $7 trillion to accomplish that. After all, TSMC had budgeted $40 billion to build a leading-edge 3 nanometer semiconductor manufacturing plant (fab) in Arizona. $100 billion could build two or three of them. It’s more than enough… as long as it is invested well.

Softbank’s Son is known for his bold decisions, which is highly uncharacteristic of Japan. Many are disasters, but a few have worked out extremely well. ARM is a perfect example.

Softbank is tripling down on its success in semiconductor technology. It hopes to create the next NVIDIA, a company worth almost $2 trillion.

If all goes to plan, Softbank may be able to wash away its past mistakes and impurities and create something incredible.

If that comes to pass, Izanagi will be pleased.

New reader? Welcome to the Outer Limits! We encourage you to visit our FAQ, which you can access right here.

If you have any questions, comments, or feedback, we always welcome them. We read every email and address the most common threads in the Friday AMA. Please write to us here.