“Fantastical”

Such a great word.

It was used by FedEx Chairman Fred Smith back in 2016…

On a corporate earnings call, when referring to Amazon and whether or not it was seen as a competitor to its own logistics business, he said, “Concerns about industry disruption continue to be fueled by fantastical — and I chose this word carefully — articles and reports.”

He dug his hole further and followed with this:

“In all likelihood, the primary deliverers of e-commerce shipments for the foreseeable future will be UPS, the U.S. Postal Service, and FedEx.”

It didn’t take long before he had to eat those words…

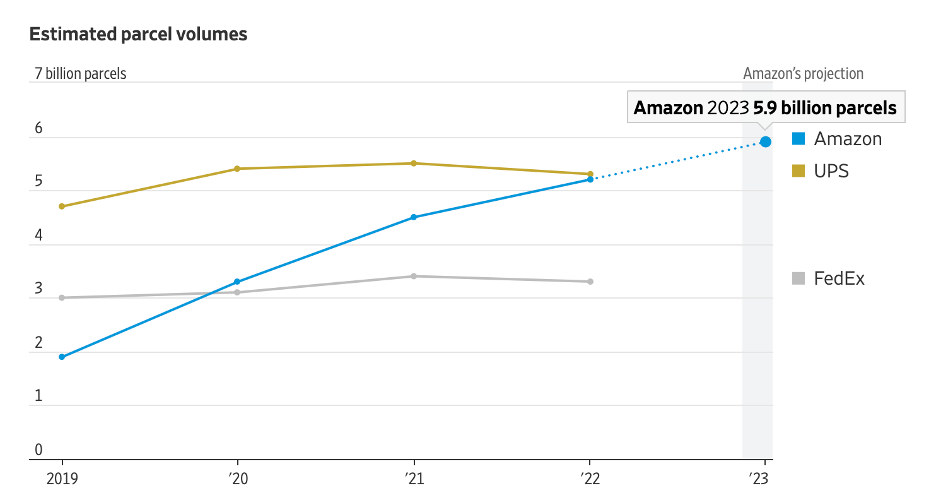

Just a few years later in 2020, Amazon had already surpassed FedEx in parcels delivered. And just in the last few months, Amazon has just passed another major milestone, something equally unthinkable…

It has overtaken UPS.

Prior to November 23th, Amazon had already delivered 4.8 billion packages in the U.S. alone. Amazon’s recent projections are that it will finish the year around 5.9 billion. It has been taking away market share from FedEx and UPS, and more significantly, it is expanding the entire market for home delivery.

Better yet, the numbers in the above chart don’t tell the whole story…

UPS and FedEx report package deliveries that include those handed off to the U.S. Postal Service (USPS). Amazon’s numbers do not. It’s figures only include those deliveries made from Amazon facilities to a customer’s home or business.

How is this possible? How could an e-commerce company overtake logistics giants like UPS and FedEx?

The answer is money and technology.

But before I explain that further, what if I were to tell you Amazon is getting ready to make its next major move…

Using the same two forces, the company is setting the stage in an effort to dominate another market…

So long as one big competitor stays out of the way.

Amazon started its journey as a simple e-commerce company selling books. It quickly expanded into a massive marketplace of seemingly unlimited products. But it was a tough business with low margins which needed to rely on third parties like FedEx, UPS, and the USPS for deliveries.

The company’s stroke of genius was to establish a new marketplace for information technology services — otherwise known as cloud computing — in 2006. This business is what became known as Amazon Web Services (AWS).

By 2013, AWS was generating $3.1 billion in annual revenues. 2014 however was the pivotal year when AWS launched its serverless computing services, allowing companies to run their software without having to deal at all with managing the computer servers or storage. This is what we know as “cloud computing.”

It wasn’t the top line revenue that was so important to Amazon. It was the healthy gross margins of the AWS business that fueled the growth of Amazon’s logistics empire.

By 2015, AWS was generating $1.5 billion in EBIT (earnings before interest and taxes), which was more than what Amazon’s North American e-commerce business was producing. By 2020, AWS EBIT had grown to $13.5 billion. And last year, it was an incredible $22.8 billion.

Amazon’s free cash flow generation, largely driven by AWS’s remarkable success, gave Amazon the capital to invest in a massive, technology-driven logistics system.

And the most critical part of Amazon’s strategy is the employment of robotics in its distribution and fulfillment centers around the world…

Smartly, Amazon leaped into the robotics space in early 2012 through the acquisition of Kiva Systems for $775 million.

The acquisition served two purposes: Kiva’s robotics technology became the cornerstone of Amazon’s robotics systems from which it could build upon.

And the acquisition of Kiva took Kiva’s technology off the market. That meant that Amazon’s logistics competition wouldn’t be able to access Kiva’s advanced tech.

As we fast forward 10 years, Amazon’s robotics technology has evolved significantly. In fact just last month, it announced its latest robotic system — Sequoia — seen below.

Amazon’s Sequoia is able to lift and transport towers containing bins of products and move them to where they need to be. No human is required to drive a forklift to shuttle these towers around.

This latest logistics robot will speed up the identification and proper storage of products by 75%, as well as reduce fulfillment time of an order by 25%. Those are large improvements, exactly the kind I look for in promising investment opportunities.

What’s next? Amazon is already partnering with Agility Robotics, a company I have written extensively about in the past.

Agility is one of the more promising robotics companies developing bipedal robots with “hands.” They have the ability to pick up and move objects. We can see one of Agility’s latest robots in the picture below, to the right of the human.

Agility’s robots will save humans the wear and tear of lifting and moving bins of goods from place to place. It is tiring and tedious work that can lead to stress and injury.

Robots won’t tire, and humans will still be needed to maintain and ensure that the robots are all in working order.

To be clear, in very short order, Agility’s robots are going to be pervasive for these kinds of tasks. The employment of computer vision and forms of artificial intelligence make them robust and versatile in the workplace.

And while their initial deployment will start in warehouses and distribution facilities, it won’t be long before we see these humanoid robots jumping out of the back of an Amazon delivery truck and deftly jaunting to our front doors to deliver our packages. Imagine the efficiency in that…

A decade ago, the thing that most didn’t understand about Amazon was that it was the leading innovator in building the marketplace for cloud services (AWS).

They also didn’t understand it was AWS that was driving Amazon’s aggressive foray into leveraging high-tech to become the leading innovator in logistics networks, giving the company a wide moat over its competitors and a lower cost for delivering the majority of its packages.

Today, what most don’t understand about Amazon is that it has become one of the most important artificial intelligence companies on the planet…

Amazon was early in deploying infrastructure at Amazon Web Services (AWS) capable of running machine learning and artificial intelligence.

AWS procures countless semiconductors for its data centers that can then be leased to whomever wants to run AI software. This strategy has been extremely effective.

And because of Amazon’s buying power, it has put the company in the position to procure the latest semiconductor technology from the most valuable semiconductor company in the world: NVIDIA.

Some of NVIDIA’s chips are nearly impossible to buy due to the demand for its products — all being driven by the explosion in artificial intelligence. That makes AWS a solution to a massive pain point in the industry.

And it’s not just cloud computing services that define Amazon in terms of artificial intelligence…

In 2020, Amazon paid $1.2 billion to acquire private autonomous driving company — Zoox.

The Zoox autonomous vehicles don’t provide for a safety driver. In fact, they don’t have a front or a back. In other words: No human driver required.

The acquisition gives us a lens into Amazon’s future strategy. It now has the ability to create a marketplace for cheap, autonomous transportation.

And it doesn’t take much extrapolation to envision a Zoox vehicle being used for deliveries — pair a Zoox with an Agility robot and we have a fully autonomous delivery system… all powered by artificial intelligence.

And not to mention Amazon’s recent foray into home robotics…

Amazon’s Astro is an early view of an “intelligent” piece of consumer electronics that can act as a security guard, or even a source of entertainment.

It’s capable of performing a wide range of tasks and can even shuttle smaller things from one place to another around the house.

There is one thing that we should be sure of: This is just the start.

Amazon is sure to deploy artificial intelligence and robotics throughout its business in order to improve efficiencies, and to its massive customer base through software like Alexa and other home robotics systems.

But it’s not alone in the space.

Tesla’s Optimus humanoid robot, and the dramatic progress that Musk and his team have made, will only act as a catalyst for Amazon to have a competitive product as soon as possible.

After all, Amazon wants to be deeply ingrained in consumers’ homes. That stickiness ensures that more business transactions flow through Amazon than anyone else. That’s why Amazon won’t want Telsa’s Optimus to gain a foothold in the consumer market.

We’re in for one heck of a battle.

Today, Amazon trades at an enterprise value of $1.6 trillion. It has impressive gross margins of 46% and will generate more than $20 billion of free cash flow this year. And while Amazon doesn’t pay a dividend, it has shown time and again that it knows how to deploy capital for even more growth.

It’s trading at a forward enterprise value (EV) to sales ratio of 2.63 and a forward EV/EBITDA of 13.6. Not expensive at all.

We’re in for some volatile market conditions in the months to come, and there will be an even more attractive entry point for this AI giant in the months ahead.

Questions, comments, feedback? We love to hear it. Please let us know right here.